By Jason Makansi, Pearl Street Inc

Grid-scale energy storage is getting lots of media attention, both within the electric power industry and in the general press. Should gas-turbine advocates be nervous?

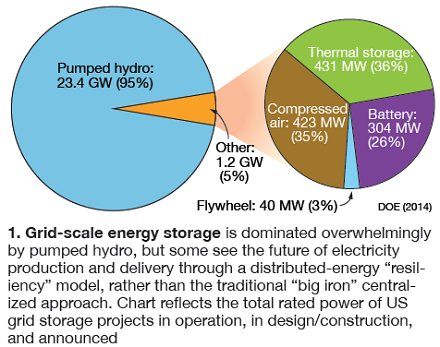

Electric utilities have relied on large-scale pumped hydroelectric storage (PHS) for decades (Fig 1). A representative from one of the largest US utilities once said, at a briefing for Congressional staffers, that its pumped-storage plant is like duct tape, it responds within minutes to manage or avoid a variety of grid-related operating problems, many falling in the category of ancillary services. More than 20,000 MW of PHS is operating nationwide.

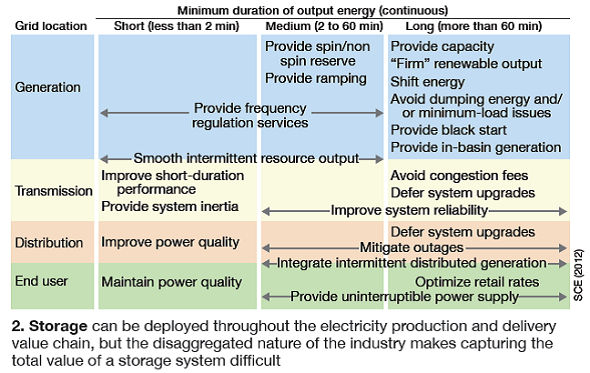

Storage today encompasses a plethora of options which can be deployed at many different points along the electricity production and delivery value chain (Fig 2) for bulk or wholesale transmission, substation support, distribution-system support, microgrids, customer-end services, and intermittent and peaking capacity (Sidebar 1). It is the last application which should interest GT owner/operators.

1. Competing grid-scale storage technologies

Energy storage encompasses a plethora of options which can be deployed at many different points along the electricity production and delivery value chain for bulk or wholesale transmission, substation support, distribution-system support, microgrids, customer-end services, and intermittent and peaking capacity. Thumbnail sketches of the competing technologies, presented below, can help the novice come up to speed quickly.

Pumped hydroelectric storage (PHS) is the granddaddy of all the technologies. Essentially water flows between an upper reservoir and a lower reservoir. During periods of low grid demand, electricity is consumed by a motor driving a pump (moving water uphill). During period of high demand, water is gravity fed through the same units acting in reverse as turbine/generators.

PHS units can respond within minutes to put hundreds of megawatts of capacity online. Capital costs are high and permitting is arduous, two reasons why none have been built in the deregulation era.

Compressed-air energy storage (CAES) is similar to PHS, except that the working fluid is air, compressed and expanded to/from storage using compressor/turbine motor/generator units. Most large CAES facilities are envisioned for use with naturally occurring or solution-mined underground caverns, although aquifers have been evaluated. Smaller CAES units employ above-ground storage such as tanks or series of long horizontal pipes.

Only the underground-cavern version has been demonstrated to date in the US. Capital costs typically approximate those for a combined-cycle facility.

Lead-acid batteries. Two large grid-connected systems were demonstrated over a decade and a half ago, and more recently several projects in the 10- to 40-MW range have come online. Several suppliers are qualified for grid-scale systems but the technology is limited by depth of discharge, number of charge/discharge cycles, and environmental issues associated with lead (even though 90% of the lead typically is recycled).

Thermal energy storage is a well-proven option that seems to get little love among energy-storage enthusiasts. TES has been around for decades. Notably, 25+ MW of rooftop ice storage units were selected as part of Southern California Edison’s recent 2220-MW solicitation to fill in the capacity gap created by the forced closing of the San Onofre Nuclear Generating Station. In sum, 264 MW of storage was selected as part of that solicitation. At night, excess electricity is used to make ice, which then is used for space cooling. Hot-water heaters also are popular for thermal storage.

Lithium-ion batteries essentially are scaled-up versions of the powerful batteries used in IT equipment and for automotive applications. The largest battery project in North America recently commissioned by SCE is of the lithium-ion variety. To give an idea of scale, it comprises over 600,000 of the same battery cells used in the Chevrolet Volt electric car. Several grid-scale technologies are being demonstrated through the DOE program

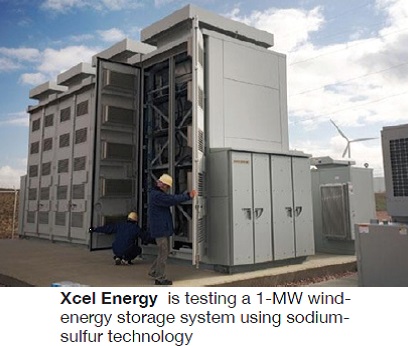

Sodium-sulfur batteries. Technically a flow battery, this chemistry appeared to be a leading contender five years ago for utility applications but has been plagued with cost, performance, and thermal-management issues. Regarding the last point, unlike other battery chemistries, sodium-sulfur requires a high operating temperature—around 600F. Several grid-scale systems have been demonstrated in the US and Japan (photo).

Sodium-sulfur batteries. Technically a flow battery, this chemistry appeared to be a leading contender five years ago for utility applications but has been plagued with cost, performance, and thermal-management issues. Regarding the last point, unlike other battery chemistries, sodium-sulfur requires a high operating temperature—around 600F. Several grid-scale systems have been demonstrated in the US and Japan (photo).

Flywheels are mechanical devices. Energy is stored in an ultra-high-speed permanent magnet-type motor/generator with a rotor made of advanced lightweight composite material. It is maintained in a “charged” state at a very high rate of speed, until the process is reversed during discharge when the rotor is decelerates at a controlled rate with the generator. The rotor slows to zero when all energy is released.

Commercial demonstration of the leading flywheel technology for grid applications resulted in high-profile failures at a DOE-funded site, but the company, and the technology, appears to be making a comeback, with new commercial facilities announced and coming online.

Flow batteries. Energy is stored and released through a reversible electrochemical reaction between two electrolytes. Because of the tanks and external fluid handling equipment, these systems look less like batteries and more like a compact chemical process plant. Regenerative fuel cells are included in the flow-battery category.

Grid-scale facilities typically are built-up using individual modules rated less than 500 kW. Several different configurations have been demonstrated at small scale over the years, but in general the category has a checkered history with respect to performance and cost.

The intent of this article is to provide a reality check on the future of storage assets in electric power systems by offering insight gained from trying to answer the question: Will storage disintermediate traditional peakers? If so, when?

Make no mistake. This analyst, who has been consulting for storage technology companies, policymakers, and grid operators for close to two decades, believes that there will come a day when storage assets are added to the grid much like gas-turbine-based (and engine-based) assets have been added over the last decade and a half.

Storage is a logical and natural progression towards more precise balancing of load and demand. Storage is also a holy grail of sorts for renewable energy, because it essentially makes a highly variable source of capacity (hourly, daily, and seasonally) behave more like traditional base-load generating assets.

Nevertheless, a sober assessment reveals that day of disintermediation is by no means around the corner. Here’s why, expressed as five reality checks:

First, most of the market excitement in the US is focused squarely on California. A recent headline in an industry publication proclaimed, “California’s energy storage mandate creates mega market for storage solutions.” Another reported, “SoCal Edison unveils largest battery storage system in US.” The New York Times reported last December, “Energy storage plans gain ground in California.”

California, if likened to a country, may represent the ninth largest economy in the world, but it isn’t like the rest of the US.

California has in place a regulatory regime supportive of energy storage long-term. Most industry people focus on the legislation that “mandates” a certain amount of storage be added to the grid. Mandate is a misnomer, however. The legislation includes “targets” for each of the state’s investor-owned utilities and a requirement to evaluate storage against other options (Sidebar 2).

In June 2013, for example, the California Public Utilities Commission (CPUC) proposed “the adoption of procurement targets for viable and cost-effective energy storage systems” consistent with Assembly Bill (AB) No. 2514. The key words, of course, are viable and cost-effective. Some might call them key loopholes.

In fact, the most important support for storage in California isn’t the storage capacity targets, but the totality of the state’s energy and environmental (emissions, thermal discharge, carbon, etc) regulations which are (1) driving the state to replace its existing fossil and nuclear capacity with renewable energy and (2) replace the “big iron” electricity paradigm (large central stations, long transmission lines) with a distributed energy model. Large and small grid-scale storage is essential to making this strategy work. California officials also view this “paradigm shift” as a pillar of state economic development.

Reality check 1: No other state is acting like California.

Second, as exciting as it is to have an entirely new asset class appear in electricity infrastructure, the grid-scale storage industry is fragmented and immature. Fully commercial systems which can meet the extremely conservative purchasing, warranty, and reliability requirements of utilities are few and far between.

The DOE’s $185-million energy-storage demonstration program (supported by American Recovery and Reinvestment Act funds) has been a shot in the arm for the industry, but it is only a demonstration program. In context, that sum is about one-third of what a 500-MW, gas-fired combined cycle would cost today.

Typically, when it comes to new technology, the utility industry, often with government assistance, demonstrates and evaluates a variety of alternative “systems” but eventually converges on a “dominant design.” Recall the evolution of nuclear units into two branches of PWR and BWRs, of sulfur dioxide scrubbers from demonstration to commercial and the dominance of the lime/limestone option, and of fluidized-bed boilers to the commercial circulating fluidized-bed (CFB) design.

Grid-scale storage has at least several years to go before convergence on a dominant design, much less convergence as to where along the production and delivery value chain storage makes the most economic sense. Except for PHS, the dozens of operating and planned storage projects located around the country represent less than one average-size utility powerplant, according to the numbers revealed in storage projects database maintained by DOE and Sandia National Labs.

Even the one technology that can compete with PHS (in terms of single units larger than 100 MW), compressed-air energy storage (CAES), is still represented by only one 110-MW demonstration facility (now considered commercial) commissioned in Alabama in the mid-1990s. At least two new CAES facilities are moving forward in development, one in Texas (300+ MW) and one in Utah, but several others have also fallen off the map.

As has to be expected during an industry-wide demonstration phase of new technology with complex engineered systems, many of the DOE and other projects have not gone so well, and others still haven’t even gotten off the ground.

Before anyone in the GT community starts gloating, they should recall the early- to mid-1990s when F-class gas turbines, sold as “fully commercial,” were being air-lifted around the world to repair catastrophic damage to rotors and airfoils. What’s more, F-class technology represented evolutionary advancements to existing, proven machine designs, rather than a wholesale new asset class.

Finally, storage devices are part of an overall complex engineered system. With the exception of CAES and PHS, storage devices require a power electronics package to convert DC to AC to DC; controls, communication, and software to interface with the grid’s market and dispatch functions; and other balance-of-plant components. The storage community has only recently begun the collaborative activities of developing and setting standards, translating system-level experience into operating procedures, and value engineering iterations.

Reality check 2: There are few truly commercial utility-grade options available.

Third, other conventional options are available which can provide the same benefits as storage systems. Some battery and flywheel options provide almost instantaneous response and unload their capacity in seconds or minutes. Other battery systems, especially the flow-battery category, are best for multi-hour charge/discharge cycles.

In other words, some grid-scale storage will be designed to function like an uninterruptible power system (UPS) and other storage facilities can be designed to provide daily cycling. There are even a few seasonal storage concepts based on hydro and large-cavern-based compressed air. CAES, for example, often is described as an “ideal” intermediate-load powerplant: charge daily for 12 to 16 hours and discharge for 8 to 12 hours. Small-scale CAES systems are available in the 10- to 50-MW range based on above-ground air storage in pipes or tanks, but they are only now undergoing demonstration.

But, just because you can send a message to someone instantaneously today doesn’t mean you need to. Likewise, emerging grid-scale storage systems can provide much faster response than traditional options, but the question is whether the improvement can be justified by the investment required.

It always pays to remember that traditional incumbent technologies are constantly undergoing evolutionary advancements while “revolutionary” ones struggle to gain a foothold. Changes to control systems and procedures have allowed owner/operators, for example, to shave several minutes off GT startups, which were nominally 10 to 15 minutes five years ago.

Gas-turbine-based powerplants, in fact, can be thought of as storage assets, too, except that the energy is stored in the gas pipeline. One of the latest combined cycles to come on-line, TVA’s John Sevier Combined Cycle Plant is a “must run” plant, but also must cycle to accommodate wind coming into the system from hundreds of miles away. Plant operators reported that the facility often ramps from 480 to 760 MW twice a day, and the gas turbines are designed for a maximum ramp rate of 45 MW/min.

Storage systems have a unique ability to put power on the grid and take it off (during charge cycles). But adding a clutch allows a simple-cycle GT to offer a similar function. The clutch, connected between the turbine and the generator, can automatically disconnect the turbine from the generator. Because the generator keeps spinning synchronized to the grid (functioning as a motor), it continues to provide voltage support (reactive power).

When power is needed again, the unloaded turbine is fired up and the clutch automatically re-engages the turbine to the generator. Granted, you won’t get the energy back, but the penalty may be acceptable, depending on what the grid operator is willing to pay for such ancillary services.

Reciprocating engines also are able to respond rapidly and flexibly. In many renewable-energy intensive locations around the country, powerplants comprised of a bank of large engine/generator units have been added which can also reach full output in seven or eight minutes.

Even older, smaller fossil-fired generating plants plants, typically located close to load centers, have been operated to provide ancillary services. They may not be easy to start up and shut down but they can ramp at rates that provide acceptable service. Similarly, hydroelectric facilities can be operated in more flexible ways to provide grid-management functions.

Legacy steam/electric units, which may have ramped at 5-10 MW/min in the past, may now ramp at 10-25 MW/min to follow intermittent wind. These may not be elegant solutions but they have been sufficient.

Flywheels are thought to be ideal for grid frequency regulation, and several facilities have been installed around the country for this function, notably in the New England and Chicago areas. For example, the ISO PJM has issued new incentives for generators to provide ancillary services.

One 3 × 1 Frame-6B powered combined-cycle cogeneration facility outside of Chicago installed a system enhancement known as TurboPhase in part for this purpose. The two TurboPhase modules installed can add up to 7 MW onto the grid within a minute and satisfy PJM’s criteria for performance-based frequency regulation.

Reality check 3: More traditional means of providing the same functions as storage may be good enough.

Fourth, it has to be repeated that the electric-power industry is not primarily driven by technology or even economics, but by regulation and reliability. Regulatory agency priorities are reliability, environmental compliance, and lowest cost of electricity (to support general economic development and keep ratepayers happy). Investment, in turn, is driven by the basic utility business model of a regulated rate of return on invested assets.

For most state regulators, storage assets are difficult to approve and rate-base because they don’t fit neatly under distribution, transmission, or generation, their traditional investment buckets. The large PHS facilities in operation today were all justified and financed under the old vertically integrated electric-utility business model.

Deregulation and competition strategies pulled the component pieces apart, so today there are ISO/RTOs, independent and merchant generators, transmission companies, traditional integrated utilities, utilities which are largely distribution businesses, etc.

Storage assets offer benefits throughout the value chain, but converting that value to revenue is exceedingly difficult given the parties involved, different business models, etc. An ISO, for example, could benefit substantially from a bulk storage facility, but it is supposed to remain asset neutral in carrying out its marketing and reliability functions. A distribution utility could improve reliability with small “community energy storage” units in neighborhoods (resembling those green transformer boxes, for example) but could only monetize a portion of the total value.

Reality check 4: The regulatory regime must be in place to support storage investments.

Finally, all of these alternatives to storage are fuel-based. It’s important to realize that the electricity charging up the storage system has been generated somewhere. Every storage device has a round-trip efficiency, meaning that 10% to 25% of the energy (depending on the technology) is lost in the charge/discharge cycle.

It’s also important to realize that the electric-power industry has been in a “capacity rich” state ever since the financial engineers brought down the economy in 2007. With the exceptions of Texas and oil-patch states like North Dakota, abnormally high reserve margins are the norm.

Incremental megawatts available from an existing plant exhibiting low-to-modest capacity factors may be responsive enough in most parts of the country, and the owner/operator may be grateful for the added duty and revenue. With natural gas at rock bottom prices, it’s going to be hard for other options to compete, at least until forward prices begin to get ugly again.

Consider the California situation. The large nuclear unit in the south, San Onofre, has been shuttered. Older fossil plants are being shut down because of onerous thermal discharge and emission regulations. The state has its own carbon cap and trade rules, and is gunning to achieve 50% renewable energy use by 2030.

Not only are fossil-fueled and nuclear plants being run out of town, the state is accomplishing de facto supply destruction of its base-load units. The totality of the regulatory regime is forcing the scenario where making renewable energy resemble base-load capacity is essential to keeping the lights on in the future. Its three main utilities are looking more and more like discos, or distribution-centric businesses. Distributed storage fits their new business model and satisfies the regulators.

Reality check 5: Large-scale storage may make sense only in California, but when that market matures, it looks to be a huge opportunity.

The moral of the story: The threat to growth of gas-turbine-based assets in California is real and large, but still at least 5 to 10 years off. Despite the regulatory forcing functions, the “targets” for the three IOUs in the state total 1325 MW through 2020, equivalent to the size of a typical gas-fired combined-cycle facility.

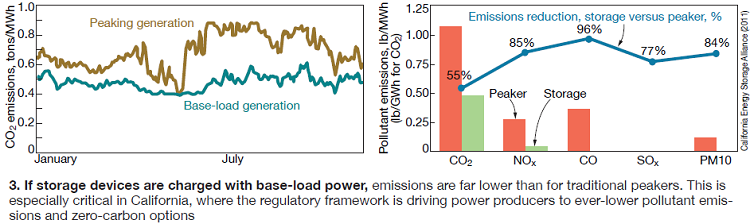

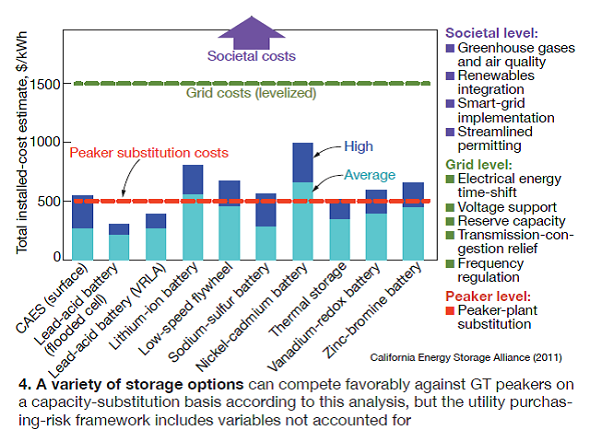

The California Energy Storage Alliance (CESA), found in a 2011 white paper, that a 50-MW lead-acid battery facility (4-hr discharge, 84% round-trip efficiency) was more economical than a 50-MW simple-cycle gas turbine/generator, based on both capital and levelized cost of generation alone, and that there were other economic advantages when grid level benefits and societal costs are monetized.

Emissions also were evaluated to be lower because storage devices would presumably be charged from base-load generating units (Fig 3). However, the lead-acid battery configurations are the lowest cost of the options analyzed (Fig 4).

The 2010 report, “Energy Storage—A Cheaper and Cleaner Alternative to Natural-Gas-Fired Peaker Plants,” further noted that the principal barrier is “current accounting of disaggregated benefits in a regulated utility industry and lack of clear policy direction to utilities that energy storage is a superior alternative” to gas-fired peakers.

2. California embraces energy storage

California’s three largest investor-owned utilities either have signed contracts for energy-storage projects, or are actively seeking or evaluating bids for storage, as directed by the state. Specifically, SCE has 16 signed contracts for behind-the-meter thermal-energy storage projects totaling 25.6 MW, six for behind-the-meter battery projects totaling 135 MW, and one for a 100-MW in-front-of-meter battery project.

SDG&E is authorized to procure up to 800 MW of energy storage but that is highly unlikely and a mixture of generation/storage resources is virtually certain, with storage a relatively small percentage of the total. Shortlisted bidders will be notified in early June.

PG&E is far along in the bidding process, too, for storage capacity plus 1600 GWh of renewable energy. While the utility is considering energy-storage proposals that are compatible with eligible renewables generation, PG&E does not have to choose a project with storage capacity if the technology does not comply with existing standards—compliance and technology.

On paper, storage can compete against peaking turbines. However, in the real world of utility economics, even when all the value can be monetized, a power system is “commercial” when deep-pockets system suppliers compete against each to meet the utility’s design specification and offer warranties, guarantees, and lifecycle service; when the regulator will likely approve the costs; when the system can be insured for loss; when all reliability impacts on the grid are known and understood; and generally when the technical risk has either been minimized or transferred to another party.

The large vertically integrated utilities (most prevalent in the Southeast) are probably in the best position to gain approval for storage from their regulators (because they can aggregate and monetize all the value points) but are also the least likely to need it. Renewable energy development is moving more slowly in those states (the exception being North Carolina) and those utilities and states are the least likely to force out their legacy coal and nuclear assets.

For the rest of the country, benchmark the threat to these factors:

- How fast is base-load fossil and nuclear capacity being forced out of the market through economics or environmental compliance?

- Are there sizable renewable portfolio standards in place or other incentives?

- Are there regulatory regimes recognizing storage assets and are attendant policies being implemented?

- Are functions such as frequency regulation, voltage regulation, spinning reserve, etc, being opened up to competitive supply?

- Is there idle existing capacity that can provide the same services as storage?

- Are distribution utilities struggling to meet local reliability and security of supply objectives?

- Are there incentives or is there value in providing wholesale grid services on a regional basis?

- Are there incentives to develop microgrids, and emphasis on “resiliency?” CCJ