Origin story sets the trajectory towards user-focused solutions

Psychologists tell us that our personalities are largely established early in life. Some even argue that by the time you turn seven, how you behave is pretty much set for life. In other words, your origin story is really, really important.

Think about that as you read this first segment of CCJ’s three-part report on PSM’s 2024 Asset Managers Conference, which doubled as a celebration of the company’s 25th anniversary.

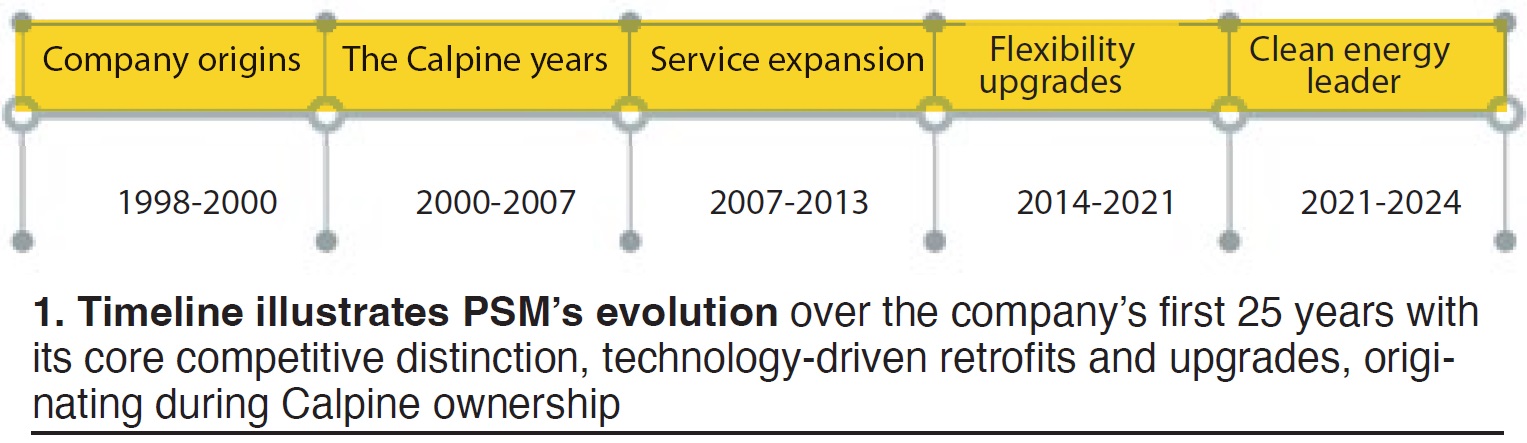

With a bit of nostalgia, the first speaker used advertisements of the day to illustrate the company’s historical timeline (Fig 1), showing its humble beginnings as an upstart non-OEM with some innovative ideas for improving gas-turbine performance, to one of the leading global, full-service non-OEM GT firms.

While the timeline in the latter years reveals several corporate ownership changes, the early years as a unit of Calpine Corp is most instructive. Calpine, itself an independent, non-utility generating company upstart at the time, set the pace in the industry for developing, owning, and operating combined-cycle powerplants.

Thus, unlike virtually all other leading non-OEM service players in the market, PSM’s formative years were spent analyzing, repairing, and optimizing machines owned and operated by the leading combined-cycle-based generating company.

An independent Genco (as they were known then) like Calpine acquiring a machine shop spun many heads at the time. Everyone who recalls the O&M issues facing advanced GT technology users during that decade can imagine the opportunity this presented for PSM. Among other pluses, PSM was able to develop collaborative solutions as an internal partner, not through the often more adversarial (especially from a legal perspective) buyer-seller relationship of the owner/operator and OEM.

Thus was set the trajectory for PSM’s focus on truly user-oriented solutions. As just one example, PSM’s GTOP product line originated as the Calpine engine optimization program. Each of the corporate ownership periods allowed PSM to gain rich experience with most of the other gas-turbine models prevalent in the marketplace.

Today, PSM is owned by Hanwha, the seventh largest company in South Korea, with $US65-billion in total sales, and ranking 296 on the Forbes Global 500 List. Not a bad landing for a company launched by a few aeroderivative machine specialists.

PSM’s 25th anniversary is not just a day

Unlike married couples who may celebrate their anniversary on a specific day, the festivities for PSM include what it describes as The AMC World Tour: Retrofit Revolution – Technology to Transform. Tour dates include June 3-4 in Accra, Ghana; July 17-18 in Kuala Lumpur, Malaysia; and November in Abu Dhabi (details to come).

One of the key messages is that the race to decarbonize will be won by the early adopters. Thus, it is critical to identify and partner with companies/consortiums for a successful and timely transition to net zero.

Another key message to be delivered during the tour is that existing assets are the foundation for the energy transition and gas turbines are essential players for decarbonizing energy production. PSM has a suite of technologies expressly designed to help its customers evolve over the long-term as hydrogen plays a larger role in the transition and higher and higher H₂ blends are adopted as a gas-turbine fuel.

In the trophy case

Along the journey from US startup to global player, PSM claims an impressive list of “first in the industry” to:

- Offer (from a non-OEM) F-class performance upgrades.

- Provide extended-interval combustors for 501F and 7F/9F machines as standard (30% lifecycle advantage).

- Offer a 7F R0 compressor blade fix.

- Develop a B/E-Class ultra-low-NOₓ (sub-5 ppm) combustor.

- Offer extended operation down to 35% load (first and only).

- Develop an advanced F-class combustor system for a hydrogen blend.

- Commercially offer an additive-manufactured F-class turbine vane.

- Introduce an E-class combustor capable of 35% H₂ fuel blend with no diluents.

- Achieve a 60% H₂ fuel blend for a frame-type machine (dry).

Familiar brands

Many of PSM’s branded technologies will be familiar to CCJ readers. Here is a quick review of where they stand today.

- The latest FlameSheet™ version, Gen VI, incorporates micro-mixing technology (more on this later), which has achieved sub-30% turndown (for the 7F) and allows better handling of highly reactive fuels like hydrogen, while maintaining emissions compliance. The technology is capable of firing up to 80% H₂ by volume in the fuel stream, and has been demonstrated on 60% H₂ for a 7EA machine.

- Exhaust-bleed technology, developed for the 7EA, is now available for the 7B/E/F and the 501F. Bypassing 10% of the engine’s air flow, when combined with inlet bleed heat (IBH), enhances turndown by 10%.

- GTOP technology collectively has added 550 MW of capacity to units around the world. That’s equivalent to a moderately sized power station.

- Compressor and turbine enhancements have led to a 2.8% flow increase without sacrificing efficiency.

- Sequential Fuel Injection (SFI) has enhanced load following flexibility up to 25% while maintaining emissions compliance.

- FlexSuite logic reduces startup periods, saving on fuel consumption and reducing CO emissions during starts and shutdowns.

60 to zero in 30

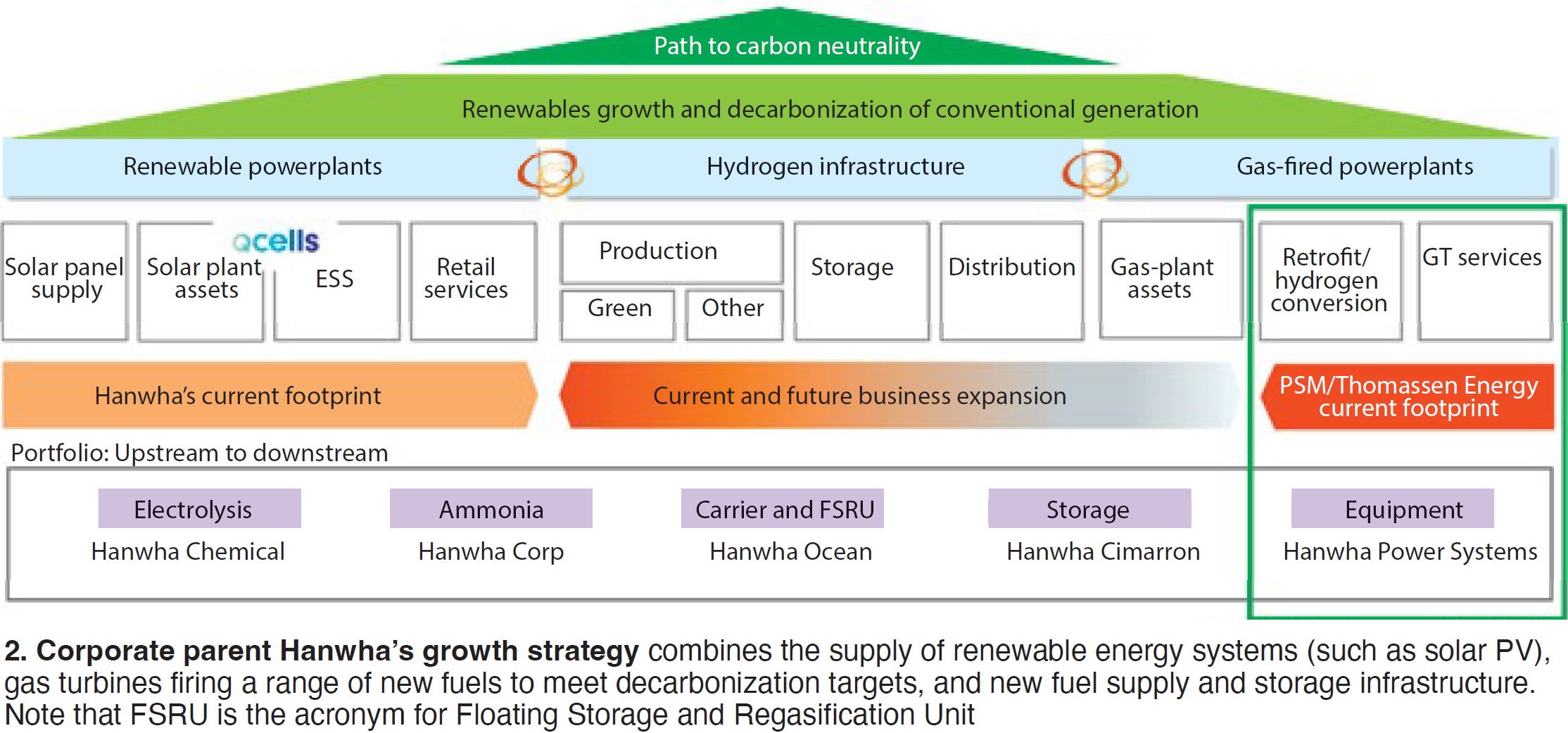

As the right side of the corporate strategy slide shows (Fig 2), PSM has a big role to play in Hanwha’s carbon neutrality growth strategy. PSM’s portfolio of services, upgrades, and retrofits (especially for H₂ combustion) for GTs marries up with Hanwha’s current base in renewables, electrolysis, and ammonia. Both PSM and Hanwha will be aggressively expanding into H₂ infrastructure, including gas storage, LNG, and floating storage and regasification (FSRG).

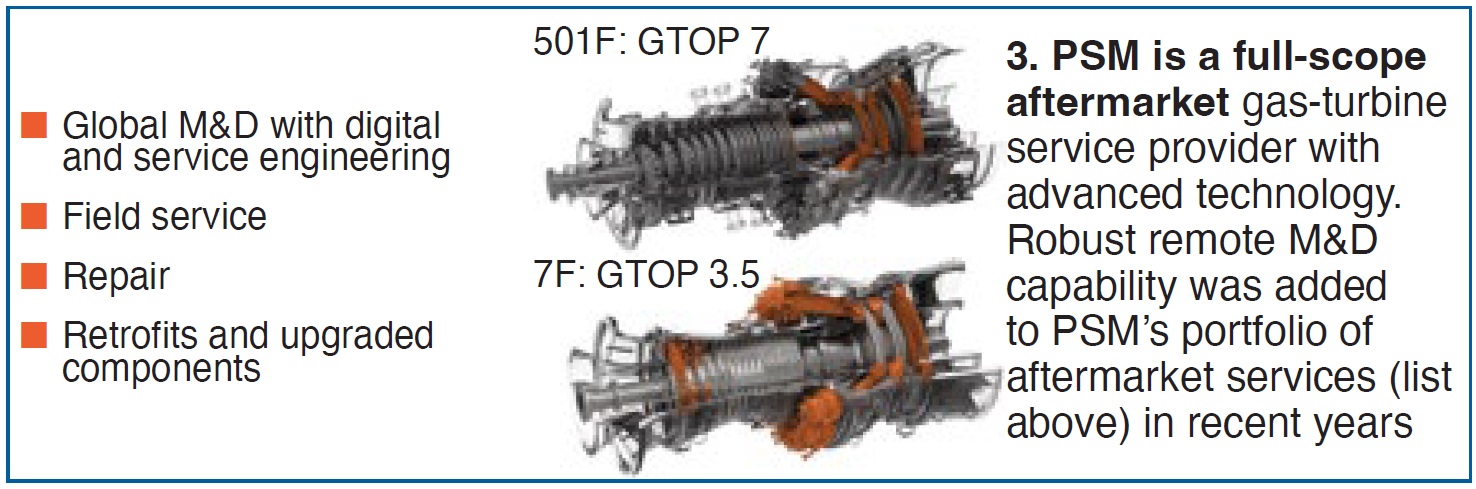

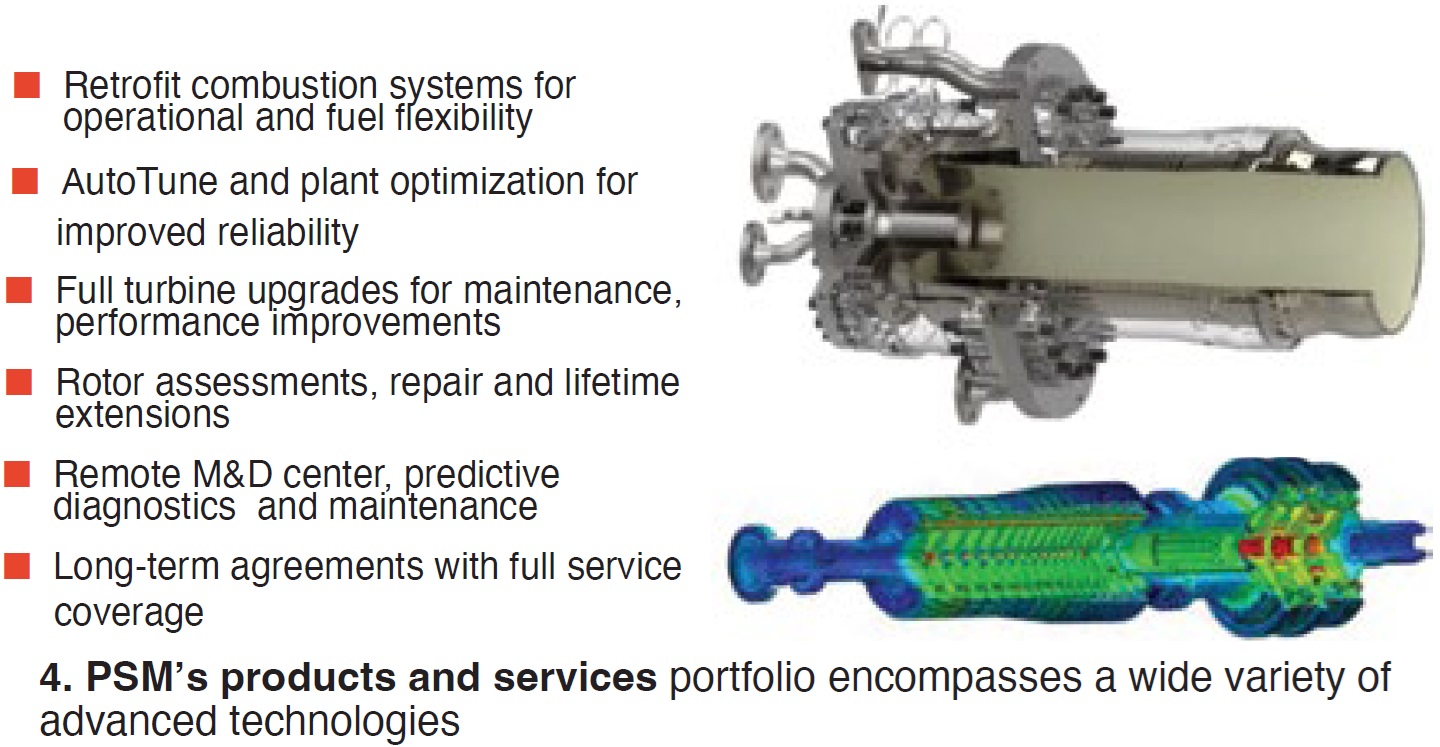

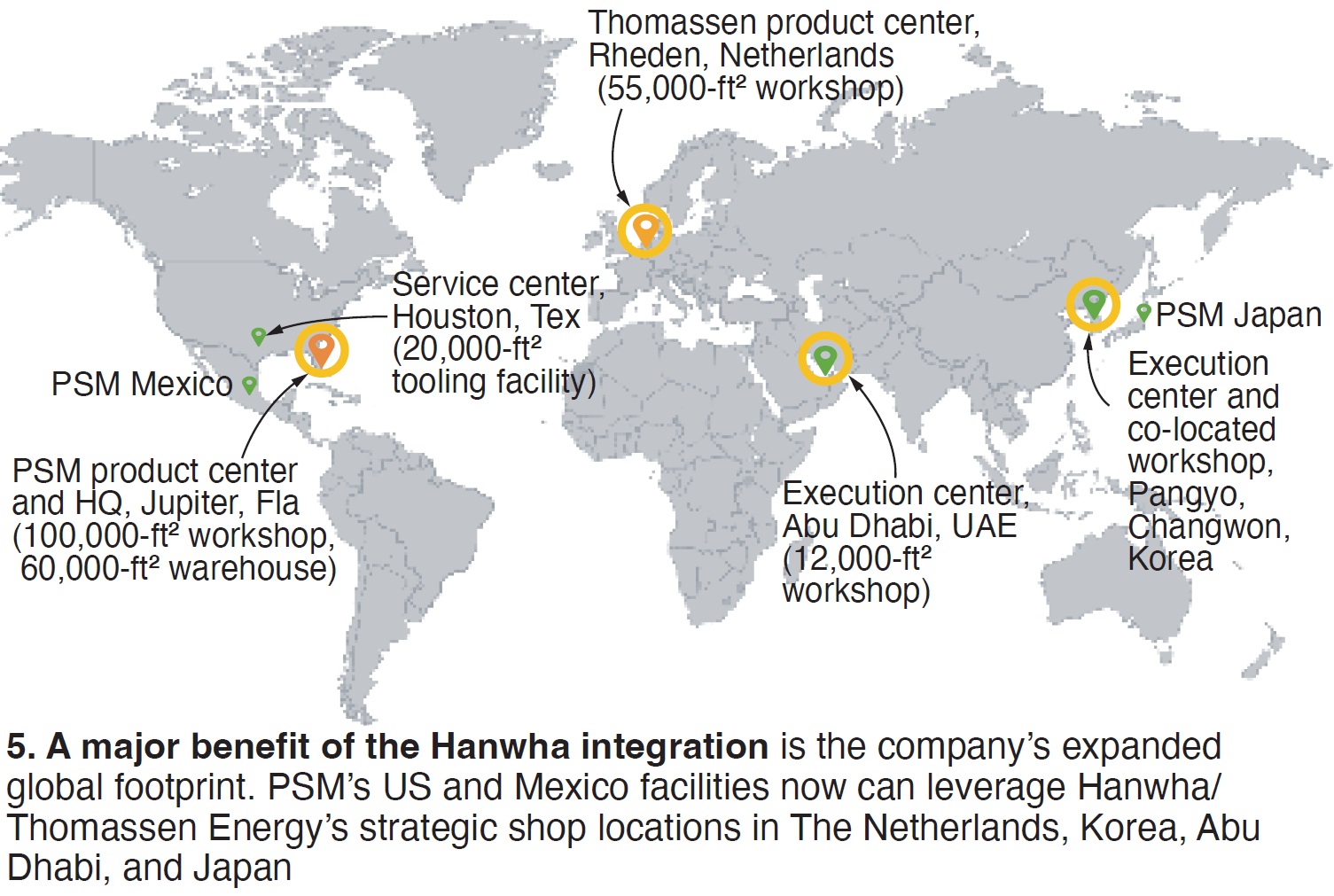

PSM’s aftermarket services portfolio (Figs 3 and 4) now includes a robust remote monitoring and diagnostics (M&D) component initiated several years ago, in addition to its traditional service, repair, upgrade, and retrofit of critical components. Incorporating advanced technology is considered to be a key differentiator from its aftermarket services competitors. The Hanwha integration expands its global footprint (Fig 5).

In 2023 alone, the company boasts 17 conversion projects, with some new product introductions. Among them: Nine FlameTops, three Low Emission Combustor (LEC) or SFI, two GTOP3.1, and three IBH/anti-icing. Add to that more than 250,000 field service hours clocked on behalf of its customers, including 50 large-scope outages. On the innovation front, the first-of-a-kind demonstration of FlameSheet technology with greater than 60% H₂ fuel blend rounded out the stellar look-back on the year.

Match technology to machine

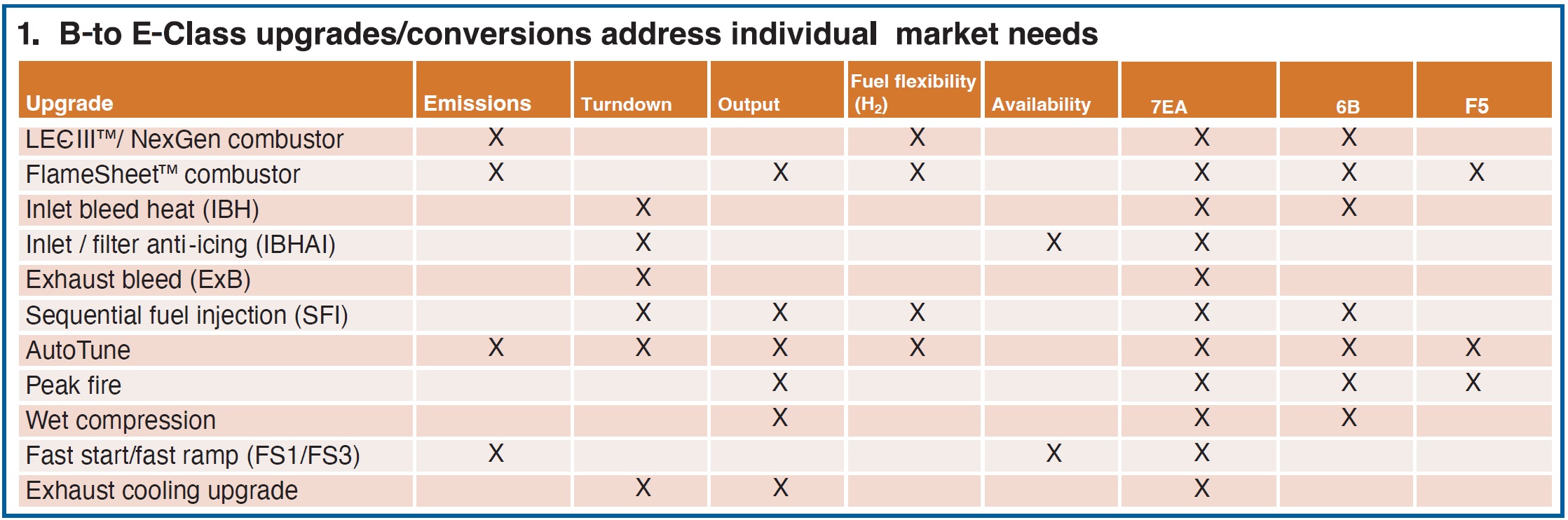

If you cross-reference your machine to PSM’s technologies (Table 1) you get an instant idea not only of what applies to your situation but the extent to which PSM has adapted its retrofit and upgrade products. The IBH system for expanding the turndown range is now available for the GE 6B, 7E, and 9E engines, as well as for Siemens 501 6B, D5, and F machines.

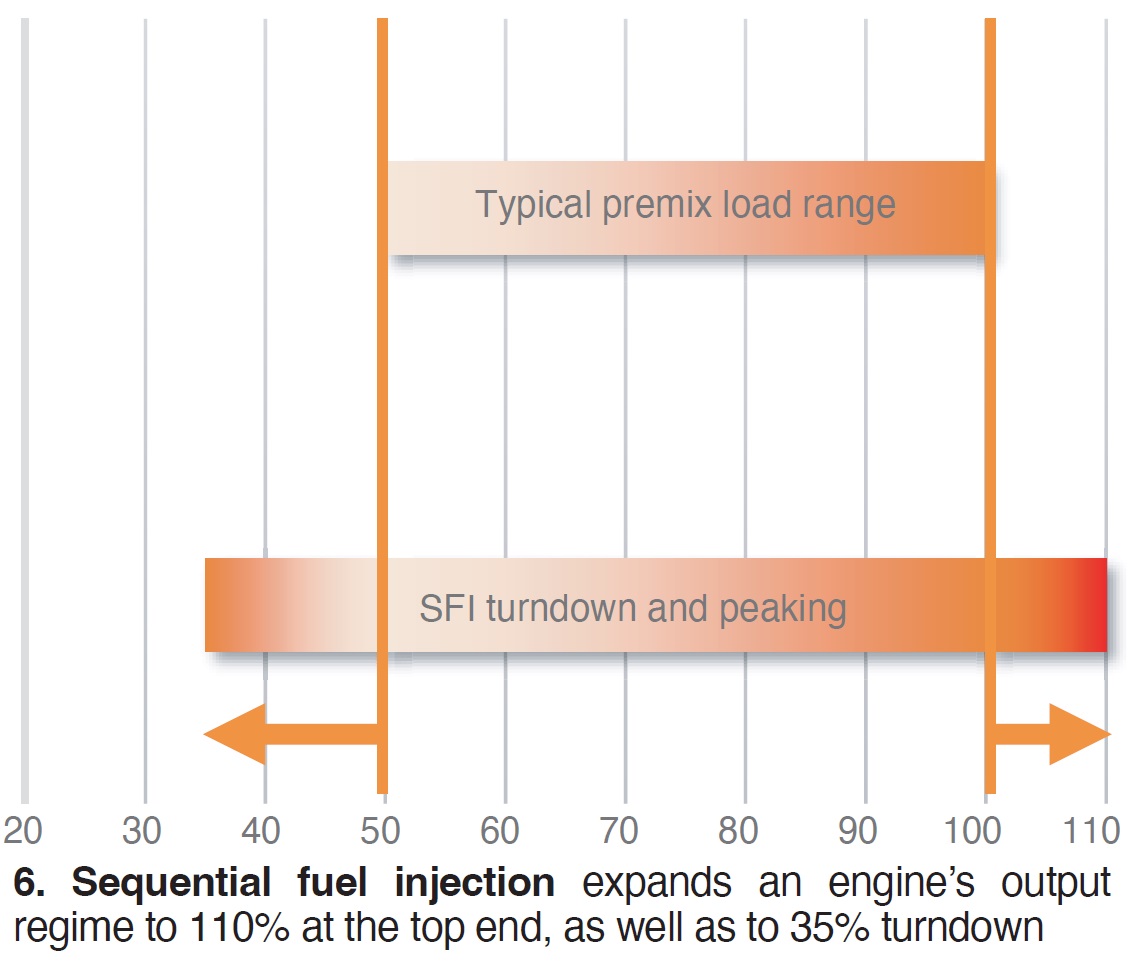

SFI (a “flameless combustion concept”), available for the 7EA, adds up to 25% load flexibility (at either end of the load range), resulting in turndown to 35% with full emissions compliance, or peaking capability for when those extra megawatts are especially precious on hot summer days. Contrast that to the typical premix load range (Fig 6).

A lesser-known technology perhaps is PSM’s virtual flame detector, which addresses maintenance issues with flame detectors on B/E- and F-Class units. By using power output as a proxy for flame presence, PSM’s FlameSheet logic eliminates the need for secondary optical flame detectors. For B/E units, the technique serves as flame detection in the secondary zone from lean-lean mode and above. For F-Class units, flame detection occurs at startup to allow engine to enter its warmup phase.

Add all of this to the company’s suite of hot-gas-path (HGP) and rotor upgrade solutions across the model range. The speaker ran through the dizzying array of hardware improvements available to owner/operators of legacy GE engines (visit www.psm.com to see/learn more).

FlameSheet™ platform

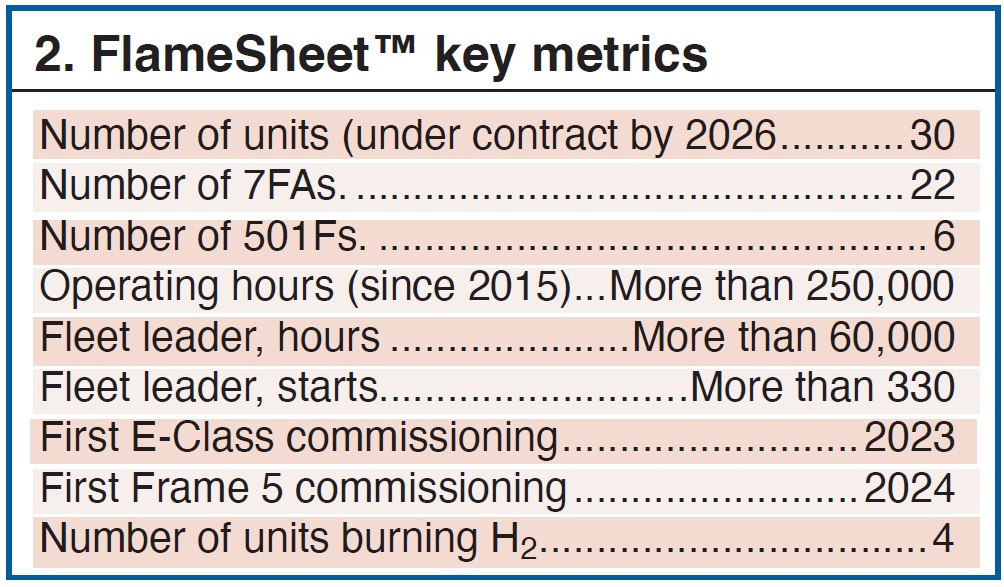

PSM’s FlameSheet technology, introduced a decade ago, has racked up an impressive list of milestones (Table 2)— including the first application to an E-class unit last year and the first Frame 5 commissioning this year. Recall that FlameSheet was developed for general operational flexibility, including up to 100% H₂ firing (depending on GT model), turndown to 30% with no sacrifice in emissions compliance, and a 32k-operating-hour/1250-start inspection schedule.

FlameSheet with Exhaust Bleed also addresses steam-cycle attemperation issues. It allows a reduction in exhaust temperature while maintaining low turndown levels, improving attemperation margins.

The technology comes equipped with an industry-leading combustor hardware protection system. An active flashback monitor/fast-runback technique protects against slugs of poor-quality fuel on premix combustors. By cutting fuel to the affected circuit, emissions compliance can be restored within 40 seconds. It has been demonstrated on the 7F and 501F. It also avoids hardware damage, outages, and trips from poor-quality fuel.

The latest generation of FlameSheet incorporates “micro-mixer” technology to better handle highly reactive fuels like hydrogen. Generically, micro-mixing refers to the goal of decreasing the “scale” of the fuel/air mixture, reducing flame length and residence time (for combustion reactions to take place), and making the mixture as uniform as possible.

This can be accomplished by reducing the size of fuel nozzles and using a larger number of smaller nozzles. PSM’s micro-mixing technology achieved sub-30% turndown in a 7F machine.

Described as a “combustor within a combustor,” FlameSheet comprises four fuel circuits—pilot, pilot tune, main 1, and main 2. Subsystems include combustion dynamics monitoring, flashback monitoring, ignition, and AutoTune. Other salient features include these:

- Aerodynamic trapped vortex for wide stability margins.

- High pre-mixer exit velocities to tolerate highly reactive fuels.

- Robust mixing techniques for tolerance to fuel Wobbe Index variations.

- Low-pressure-drop combustor for improved heat rate and smaller footprint.

Navigation tools

The conference included a panel, “Navigating Industry Trends and Challenges,” with heavy hitters representing a broad swath of the owner/operator community: Claude Couvillion, senior VP, operations and development, Middle River Power; Steve Kellogg, hydrogen strategy advisor, ExxonMobil Low Carbon Solutions; Tom Long, senior VP, asset management and outage services, Calpine; and Lee McFalls, COO, Kindle Energy (Fig 7).

There was broad concurrence on the need for regulators to remain technology-agnostic and give industry players the flexibility they need to achieve the proper balance among technology selection; federal, state, and local policies; and market forces which vary considerably from ISO to ISO and region to region.

Limitations on energy-storage solutions and carbon capture and storage (CCS), while presenting opportunities for development, mean that the firm power produced by GT-based power stations will always be critical. Aging infrastructure presents a separate challenge.

Calpine’s Long noted that the company operates 26,000 MW in 22 states and is the world’s largest geothermal plant owner/operator. Calpine, which prides itself on its innovation culture, has 700 MW of battery storage facilities operating or in development in California, as well as other solar and thermal projects. It considers CCS a “critical” piece of future infrastructure and has secured funding for two major CCS projects in Texas and California. Long briefly mentioned H₂ as a solution percolating back two decades.

It may be surprising to learn that a huge “fossil fuel” extraction and production company like ExxonMobil (which also operates a fleet of 330 gas turbines) has reorganized into three primary business segments, one of which is “Low Carbon Solutions.” The company is supporting the segment with a projected $20-billion of investment by 2027.

Kellogg lists the company’s net-zero ambitions as (1) to reduce GHG (greenhouse gasses) intensity by 20% to 30% by 2030, (2) to achieve net zero for its Permian Basin assets by 2030, and (3) to achieve net zero for Scope 1 and Scope 2 emissions by 2050. ExxonMobil sees supplying hydrogen and ammonia fuels to the power market and CCS services as two key areas for growth.

Note that Scope 1 emissions are direct GHG emissions that occur from sources controlled or owned by an organization; Scope 2 emissions are indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling.

Couvillion lamented the “lack of foresight” on the part of regulators, and called out New Jersey in particular, for forcing the shut down of plants without due consideration of economic and environmental impact. Middle River is a private equity firm which manages investments in distressed assets. They are adding battery storage assets in California and expanding in the PJM market.

Batteries are a diversification strategy, even though large-scale battery additions could compromise the lifespan of its GT assets. Batteries help the company secure long-term contracts with community choice aggregators (CCA) and utilities and stabilize revenues under varying market scenarios.

Kindle Energy is responsible for 10,000 MW of power, primarily in PJM. McFalls was especially proud of a significant new project in Louisiana, the Magnolia Power Generating Station, a 700-MW 1 × 1 combined cycle powered by a 7HA.03 gas turbine and scheduled for completion next year. McFalls also underscored the company’s resilience in Ercot during the most recent winter storm.

Other notable gems distilled from the panel discussion:

- The CCA program in California has enhanced competition among suppliers.

- PJM is experiencing significant “market constraints,” exemplified by its request for 200 MW by June.

- Scarcity of manufacturing resources creates long lead times for new units, so current focus is on preserving and upgrading existing assets, especially GTs.

- While developers of new GT projects in California typically experience protracted approval times, the state has been able to expedite approval for “energy infrastructure upgrades” to respond to crises.

- PJM is receptive to carbon-capture projects, especially when integrated into existing CO₂ transport and delivery infrastructure.

- The pros and cons of pre-combustion (natural gas reforming, for example) versus post-combustion (amine-based stripper processes) carbon removal proved to be a hot topic, especially regarding siting, available space, process complexity, costs, and long-term contract pricing for captured CO₂.