By Thomas F Armistead, Consulting Editor

Powerplant operators, with good reason, are deeply reluctant to make changes in the basic components that their plants depend upon. There is simply too much at stake—system reliability, cost, lost revenue—to tinker with the operation of a plant that functions reasonably well 98% of the time. “If it ain’t broke, don’t fix it” is the principle that restrains creativity in plant operation. But a growing number of operators have recognized that their turbine fluid systems are, in fact, “broke.” Varnish problems have driven them to look for a non-varnishing lubricant and hydraulic fluid for their power-generation systems.

At the 2009 7F Users Group meeting, one of the largest US utilities presented its experience with synthetic polyalkylene glycol (PAG). At a repowered 2 × 1 combined-cycle plant in Oklahoma, AEP Resources Inc switched one gas turbine (GT) from a hydrocarbon fluid to a PAG during a hot-gas-path inspection in November 2007. The second turbine was converted in March 2008. The senior engineer responsible for the change-over expressed complete satisfaction with the ease of the switch. More importantly, the turbines had experienced no varnish deposits since completing the change-over.

Calpine Corp also took the plunge in November 2007, converting one of four GTs at Oneta Energy Center, Broken Arrow, Okla, to PAG with equally satisfactory results. Oneta’s two 2 × 1 7FA-powered combined cycles were troubled by varnish and carbon build-up (in servo valves, pencil filters, reservoir interiors, and piping), which was attributed to turbine-oil degradation caused by high heat and friction. The problems with varnish and sludge disappeared after the conversion to PAG (sidebar).

Varnish is notoriously difficult to clean out once it has been deposited. Calpine prepared for the lubricant switch with a complete varnish flush using a cleaning formulation in the original oil. Varnish and sludge were removed from system components. Next, 3500 gal of PAG was circulated through the GT and drained. Then the system was refilled with fresh PAG. AEP, by contrast, cut to the chase: To make the switch, the plant simply drained the existing oil and refilled with PAG, bypassing the flush step.

In 2009, that was the story for the 7F UG: Three turbines converted—promising, but not enough to start a stampede to PAG. Since then, however, more powerplant owner/operators have used PAG to clean up and protect 82 more units. CCJ recently interviewed several of the engineers in charge of those units, and all spoke positively of their experiences with PAG.

We are sharing what we have found for the information of our readers, much like the information exchange at a user-group meeting. Plant managers and engineers considering replacing their turbine fluids with PAG should conduct their own investigation of the alternatives, their pros and their cons, and should not assume this article is the final, authoritative word on the subject.

Skidding to a stop

NV Energy operates 53 combustion turbines and has converted eight 7FAs units to PAG, said Gary Crisp, senior engineer. The utility typically uses soluble varnish removal (SVR) skids on its turbines, but has taken out of service most of the skids servicing converted units. “It varied from plant to plant, but many plugged in the skids, ran them for a period of time, but then saw very little results in the MPC (membrane patch colorimetry) patch test, which is your test for varnish,” he said. “Candidly, our filtration and treatment skids that we had in service did not work well and were taken out of service on the units that had been converted to PAG.”

Varnish caused a few trips in the year before the conversions. Two gas turbines were converted in December 2012, four in March 2013, and two more in April 2013. But NV Energy’s decision to convert and avoid varnishing issues was not driven by the number of trips, Crisp said. It was primarily related to the industry experience and obvious benefits of the converted systems.

Crisp noted that crews have not had an opportunity to see inside the reservoirs since the fluid conversions were completed, but indications are that varnishing is not a growing problem. He noted that there are 22,000- and 32,000-hr GT parts that have not needed to be accessed. “And, we haven’t had issues with losing control of inlet guide vanes and sticking servo valves,” he added.

Pleasants Energy LLC, a subsidiary of GDF Suez Energy North America, operates two simple-cycle 7FA turbines in St. Marys, WVa, commissioned in 2002. As peaking units, their run time is low, but their combined lube/hydraulic system is in continuous operation with the units on turning gear, said Gerald Gatti, plant manager.

During the past few years they experienced increased varnish issues in the lube oil. “Varnish is accumulating in the system and building up, typically on some small servo filters, similar to where other gas-turbine users have experienced problems with varnish,” he said. “Although we did not have any plant trips due to varnish, we did experience failed starts several times. I’m sure if the plant was running a lot more, we would ultimately also have plant trips caused by the varnish buildup in the system.”

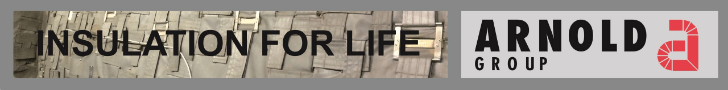

Gatti arrived at the plant in 2012, and one of his first jobs was to find a solution to the varnish problem. The plant had purchased a varnish removal skid and initially installed it on Unit 1 because the lube oil in that unit had higher varnish levels than Unit 2. The varnish level dropped quickly but then trended up again, “because the original filter canisters had expired. They get saturated pretty quickly when you have that much varnish in the oil,” Gatti said.

The operators went through several sets of filters at a cost of about $4000 each. “After one year, the varnish level in the fluid had been reduced to acceptable levels, but the SVR didn’t remove the varnish that was already plated out within the system or reduce varnish formation,” Gatti said. The plant still had servo filters clogging with varnish throughout the system.

Searching for a solution, Gatti found The Dow Chemical Co PAG products. Dow owns the PAG patent and manufactures PAG in the US for global distribution under the name Turbine Fluid TF-25. The exclusive right to sell PAG in North America is held by American Chemical Technologies Inc (ACT), which markets it under the name EcoSafe TF-25. While TF-25 can entirely replace a plant’s turbine fluids, the EcoSafe line of products also includes Revive, a PAG fluid designed to be added at a 10% level to repair a hydrocarbon-based turbine fluid with elevated varnish potential ratings.

Gatti talked with other users about their experiences with TF-25. “In all cases we were getting positive feedback from other plants, both within our own company and outside our company on the Revive and the TF-25,” he said. Estimating the cost of replacing the existing turbine fluids with mineral oil or TF-25, he concluded “the cost was not that much different.

“What I learned really drives up the cost on mineral oil replacement is the cost of cleaning up the system,” he said. “The cost of the oil itself, let’s say, is half the price of the PAG, but when you add into it the cost of doing a full system flush using 4000 gal of flushing fluid, system cleaner, and several days with the contractor to do it, it can add up to another $80,000 of expense.

“When you add those together it’s comparable to the cost of TF-25 and a system cleaning using a PAG-based product (Revive or UltraKlean) in the system for up for 90 days prior to the replacement. You can then just dump the old mineral oil out and put TF-25 in. With that process you minimize the expense and eliminate the need for a complete system flush.”

EcoSafe UltraKlean TO is a discontinued ACT product similar to Revive, said Jim Kovanda, ACT vice president. “Although it uses the same base stock as the EcoSafe Revive fluid, it is designed to be circulated for 90 to 120 days, drained, and the system filled with EcoSafe TF-25 or turbine oil,” he said.

ACT discontinued the manufacture and sale of the product last year because “users were leaving the UltraKlean TO in the systems, well beyond the recommendations, putting the product and system at risk,” he said. Revive, designed for extended use, now is the only PAG base-oil modifier ACT sells.

Gatti was hesitant to try PAG fluid, mainly because the company had no experience with it. “It was a big step for us to say we’ll be the corporate guinea pig to try this,” he said. A couple of developments helped push him over the line.

In June 2013, GE removed a major barrier to industry acceptance of TF-25 when it revised its gas-turbine lubricant recommendations document, GEK 32568h, to explicitly recognize Dow’s PAG-based synthetic turbine fluid as an alternative to mineral oil.

Gatti took further comfort in an endorsement by a cogeneration plant manager in Maine he spoke with who had converted his system to TF-25. “They were definitely happy with what they did,” he said. Finally, he asked some oil manufacturing engineers what negatives they saw in it, and lack of long-term experience was the only thing they identified. “They currently don’t have anything to directly compete with it,” he said.

Testing the claims

While weighing his options, Gatti conducted an experiment. In November 2013, he put 660 gal (10%) of UltraKlean in Unit 1, with the intention to run it for 90 days, then dumped it and recharged the system with TF-25 (Fig 1). At the same time he moved the SVR skid to Unit 2 and put in 10% Revive (660 gal) to work together with the skid (Fig 2). After 90 days, lab analysis reported that results were good for both systems.

“The UltraKlean actually worked similarly to the Revive, even though the difference between the two is special additive packages that they put in the Revive for long-term use,” Gatti said. Both modifiers dissolved the varnish that had been plated out and kept it in solution. “That’s the big benefit,” Gatti stressed: keeping the varnish in solution. Revive is twice the price of UltraKlean because of its formulation. Gatti has been running both the Revive and the UltraKlean for more than a year now with good results.

Having used both the side-stream filter and the PAG, Gatti says the skid “certainly removed the varnish from the fluid. But it didn’t dissolve the varnish that’s already been plated out in the system,” he said. “We continued to see small pencil filters that were plugging up with the varnish.

Since we put the UltraKlean and the Revive in, those filters have been spotless. We were changing out these little servos every six months, whether we ran the plant or didn’t run the plant, because they were caking up with the varnish. The filtering skid is a good way to prevent varnish from building up, but once you have it built up, it’s difficult for the skid to clean it.”

The hydrocarbon-based turbine fluid’s life expectancy is seven years, but no one knows for sure what the life of PAG turbine fluid will be because its field experience dates back only to 2007, he said. “I’m sure it would outlive mineral oil.”

Saving a trip

Turbine trips were a major problem at another plant with two 7FA units, which the owner asked us not to identify. “Almost every time we’d start we’d have an IGV (inlet guide vane) trip fault,” said Johnathon Drake, process owner, fleet maintenance. “We’d have to go reset it, stroke the valves, and then we could start up. But we probably have had 12 to 15 trips in the last year.”

Trips would occur after the plant had been shut down for several days, Drake said. “Sometimes in a run of several days there could be a trip on day two.” The existing varnish removal skid gave disappointing results, producing QSA numbers running between 40 and 60, indicating high varnish potential. Skids at some other plants in his company’s system gave good results but required several months to get them.

Drake introduced Revive to his system in August last year and has experienced no varnish-caused trips or fail-to-start events since then. Only one thermocouple burned up, he said. “From talking to the user references provided by ACT, we were expecting to see good results. The results we’ve had have exceeded our expectations,” he said. “We’re more than pleased.”

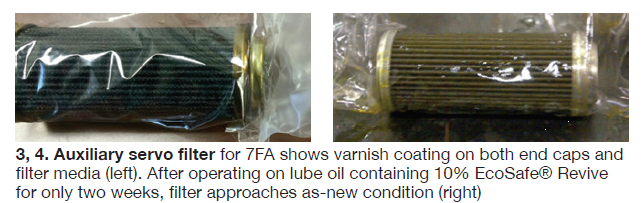

Before his plant used Revive, the varnish potential rating was 91. “The last several samples we’ve drawn, the varnish potential is down to 9 and 7, very healthy oil for varnish potential,” Drake said. He has not pulled any pencil filters to check how they are affected, but he has pulled a couple of hydraulic filters just for inspection, and they looked good. “We put in new filters in the spring time frame of 2014 and we started experiencing a lot of trips again in late July. We pulled some of those filters out and they were really gunked up,” he said (Figs 3 and 4).

Drake used Revive to solve a problem, not just as a test. But a major outage is scheduled this year, and he plans to change out the oil. Mineral oil is an option, but the company is using the time until then to evaluate PAG.

TF-25 costs $25 to $26 per gal, Drake said, but he sees Revive as a cost saver. “If we’ve got the Revive in there, and it gets the varnish back into solution so it doesn’t plate out, whenever we make the conversion (to TF-25) we’re not going to have to do the high-velocity oil flush. That’s going to save us about $250,000 to not have to complete that rinse-through.”

The Revive has resolubilized the varnish, which will be dumped, so the system will not need a flush to clean it for TF-25, he reasons. His plant is designated the fleet’s test site for conversion to PAG. If the conversion continues to deliver the results seen so far, 12 other units could be next in line, he said.

What causes varnish and how PAG helps

Solving a varnish problem is a matter of basic chemistry. The main elements are polarity and the principle that in chemistry, “like dissolves like.” This is a rule of thumb that refers to the fact that a material will dissolve in solvents only when both the material and solvent molecules exhibit similar chemical polarity.

Petroleum oil—the traditional base stock used for turbine lubrication and hydraulic systems—is non-polar. The stress of being used as a machine lubricant accelerates the aging of the petroleum oil, resulting in oxidation. This oxidation results in decomposition byproducts that are polar. Because the oxidation byproducts are polar and the base stock non-polar, the byproducts are not soluble and come out of solution as varnish. Once out of solution, decomposition by-products are tenacious, will agglomerate, can clog filters, and ultimately plug tight-tolerance servo valves. Turbine trips may result.

Polyalkylene glycol (PAG), by contrast, is polar. It is highly oxygenated, with every third atom being oxygen. PAG does oxidize; however, the oxidation byproducts are polar and infinitely soluble in the base stock. To move past varnish problems, some end-users have completely replaced their petroleum-based turbine fluids with PAG. Others have modified their petroleum turbine oil with an oil-soluble PAG lubricant to shift the oil’s polarity. In both cases, the polar nature of the base oil dissolves the polar byproducts. Everything remains liquid. That’s the chemical principle: Like dissolves like.

To date, end-users have converted 51 turbines to PAG from mineral oil. Turbine operators have modified their existing mineral oil lubricant with PAG in 34 additional units. Reports from turbine operators in both categories have been uniformly positive. Some of their stories are told in the main article.

Other experiences

In April 2012, all three of the Frame 6B gas turbines at Atlantic Power Corp’s Morris Cogeneration Plant were in “critical varnish status.” Facing the need to replace the turbine fluid as well as do a varnish flush on each of the three lube systems before recharge, O&M Manager Joe Nichols investigated the EcoSafe Revive base-oil modifier as a possible alternative. Long story short, just 30 days after 10% Revive was added to Unit 1, the unit’s fluid was substantially improved, with a 2-deg-F drop in bearing temperature.

The total cost of mineral oil for the plant, including oil, skid and sample analysis, was $48,600 per 6B GT, Nichols said, and the fluid had a life expectancy of six years. Maintenance to servos and filters per gas turbine was $2100 annually and varnish removal resin cartridges $4700 annually, not counting the cost of downtime required for the maintenance and cleaning.

He estimates that the plant had experienced five trips and failed starts total on two of the units in the two or three years before converting to TF-25 lube oil in summer and fall 2013. To the costs of those trips he added costs of downtime for routine servo maintenance and cleaning.

The total cost of TF-25 for the plant was $66,150, with an anticipated life of 10 to 12 years, and zero cost for operation and maintenance, Nichols said. Since conversion, he has experienced no varnish-caused trips. Unit 2 was charged with 10% Revive at the end of 2014, and Nichols plans to recharge the system with TF-25 at midyear after the Revive cleanse is completed.

In using Revive, Nichols was “looking to extend the life of the existing mineral oil,” but it didn’t completely satisfy his hope. Based on high soot particulate in the systems, this location presented a unique case. The EcoSafe Revive “brings varnish back into solution and releases trapped particulate contamination,” he said. “When the system was restarted the particulate matter quickly plugged up the inline filters at an accelerated rate—twice in 90 days, which was unexpected.” Sources say that is to be expected in a peaking plant that is idled for several days, allowing suspended particulate to settle out.

Another Atlantic Power plant, Frederickson 1 Station, is using 15% Revive in its 7FA gas turbine and A-11 steam turbine. The plant was constructed in 2002, and the turbine oil is still the original fluid. Richard Chernesky, plant manager, intends to migrate to TF-25 in 2018 and is counting on the Revive to extend the fluid’s life till then. “With the 15% EcoSafe Revive in the system, the varnish will be solubilized and the oxidation package to the original Group II oil will be reactivated,” Chernesky said. Frederickson 1 has converted air compressors and hydraulic units and will convert cooling-tower gearboxes to PAG products, he said.

Before adding the 15% Revive about three years ago, “we used a combination of cellulose and resin element Fluitec low-flow, high-retention, kidney loop systems to handle the quasi-soluble oxidation byproducts with success,” he said. “The Revive basically changes the state of the varnish, solubilizing the agglomeration, so the element filtration resin chemistry has changed to effectively polish the new composition. To date, it’s still effective; with continuous predictive evaluation, in the future the resin element may not be required.”

Tales of the pioneers

One of the earliest adopters said he can’t estimate life expectancy of the PAG fluid in his plant, but it is still working well seven years after the change. Jeff Volz, maintenance manager for EthosEnergy Group, was one of the presenters at the 7F Users Group meeting in 2009, when his plant was owned by Calpine. He converted one of his four 7FA turbines to TF-25 in 2007, but only recharged a second one with mineral oil and relied on a filtration skid to keep it clean for budgetary reasons.

All four had experienced a total of 11 trips in less than a year before that, and the one with PAG has run without a single trip since then. “Varnish will have to be monitored and mitigated as long as we are using mineral oil, which produces varnish. The second round of mineral oil we used has been a lot more successful,” he said.

The other early adopter at the 2009 UG meeting said his converted turbines had experienced no varnish deposits in the nearly two years of operation since the conversion. In a recent interview, David Smith, senior engineer at AEP’s Northeastern Station, confirmed that is still the case after seven years of operation.

“Our greatest issue was losing our units unexpectedly,” Smith said. “There were many trips before we knew what was causing the problem, and depending on system demand, we sometimes started back up without replacing a servo.” For an interim fix, plant staff changed out control servos. “I would put a conservative estimate at 50 trips related to varnish,” he said. The plant went through 18 servos before the conversion.

The plant also tried other solutions, including filtration skids, but the results were not satisfactory. “We tried electrostatic filters, which removed insoluble varnish, but not the soluble. Right before changeout, we tested a prototype resin filter that seemed to remove soluble particles. Neither did both,” he said. “Had we decided to stay with oil, we’d have had to perform a detergent clean of the system, which at the time was about $50,000 per unit.”

Operation and maintenance cost since the conversion has been “just routine changing of filters,” the same as is required for conventional fluid, he said, and replacement of the PAG fluid is off the radar. “From the sample analysis I’ve seen, there seems to be little to no degradation of the fluid. I thought I saw someone make an estimate of 45 years’ longevity, he said.

Unit dependability was the principal benefit AEP sought from the fluid change, and it has become even more crucial than it originally was. “Since we made the conversion, the electricity market in our area has changed to a bidding market,” Smith said. “Each day, electricity is bid for the next day and if the bid is accepted, then the generating units are committed to supply power at the day’s price.

“If a generating unit should trip during its time of commitment, the lost power has to be replaced at spot market price. Most days this is not catastrophic, but if it’s an exceptionally bad day for electricity prices, it could be. For example, normal electricity prices go on average for around $35 to $45/MWh in our area. On one very cold day last year, the spot market price went to $396/MWh. If we had lost the 460-MW unit we converted on that day, you’re talking more than $182,000/hr to replace. I can’t stress enough how important the dependability is.”

Conversion tips

Hydrocarbon-based turbine fluid costs $10 to $12/gal; EcoSafe TF-25 costs $25 to $26. Given that price differential, TF-25 has to deliver a lot more value to justify a change. The user experiences described above illustrate how many of the plants have justified the costs of the change: Some found that avoiding the cost of a high-volume flush and the contractor to perform it made up a large share of the spread, but all cited the complete absence of varnish and the problems it caused in the form of trips and the costs and inconvenience that attend an unplanned system shutdown.

NV Energy’s Gary Crisp justified the fluid replacement cost because “we weren’t getting rid of our varnish issue with the treatment skids” and varnish problems were increasingly a high priority for a growing number of the company’s powerplant O&M leaders.

Like Gerald Gatti at Pleasants Energy, Crisp took further comfort in the decision to make the conversion because GE now accepts PAG fluids as an alternative lube for its turbines. “Changing something with GE is a pretty significant deal,” he said. After the change-over, he said crews found that, in addition to getting rid of the varnish issue, the viscosity index was a little better and units were experiencing a 2- to 5-deg-F reduction in bearing metal temperatures.

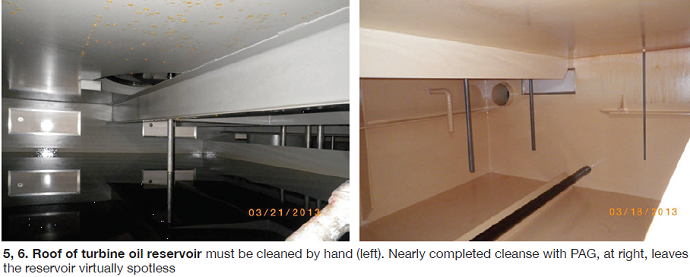

Users may take several different approaches to the change-over. After running the Revive system cleanse, NV Energy drained the system, with special attention to all the low points in the system, before refilling with TF-25. The reservoir was “virtually spotless except for the roof,” which the TF-25 had not touched, Crisp said (Figs 5, 6). “It really cleaned up the bathtub rings that you typically see in your reservoirs (Fig 7).”

The utility also requires that oil deliveries use only ACT tanker trucks to avoid contamination from other fluids. It costs a bit more, but it’s worth it, Crisp said. ACT actually came and witnessed the deliveries to provide technical and moral support, he said. Also important is to use a dedicated flushing contractor (Fig 8). “I don’t think you want the plant to do it. You want somebody who has specific experience in this arena,” Crisp said. CCJ