Chuck Casey opened his first meeting as president of the Western Turbine Users Inc with the confidence and polish of a veteran leader. He began the 24th Annual Conference & Expo in Palm Springs, Calif, March 23-26, by announcing personnel changes in the WTUI leadership.

John Baker, who manages a 1 x 1 combined cycle for Riverside Public Utilities (RPU), completed his three-year term on the Board of Directors at the meeting, and Charles Byrom, a plant manager for the Anaheim Public Utilities Dept, resigned his director position because of impending retirement. Devin Chapin, Turlock Irrigation District, and Jermaine Woodall, Exelon Generation, were elected to fill their vacated seats.

All other officers, board members, break-out session chairs, and support personnel continue in their current positions. Specifics are available at www.wtui.com and in the previous issue of CCJ, p 81.

Casey, the utility generation manager for RPU, announced that this was the third meeting in the last five years with over 1000 attendees, including 347 owner/operators. More than 350 companies (users and vendors) were involved in the conference; their representatives came from 39 states and 11 countries (Canada, Australia, Netherlands, Tanzania, Brazil, Mexico, Argentina, UK, France, Belgium, and Ecuador). The 227 companies participating in the exhibition filled nearly 90,000 ft2 of display space.

By show of hands, about one-third of the attendees were first-timers. At the other end of the spectrum, about 20% had been coming to Western Turbine meetings for 10 years or longer. A handful acknowledged having been around since the beginning—including APR Energy’s Brian Hulse; WTUI Treasurer Wayne Kawamoto, plant manager, Corona Cogen; Mike Raaker, Raaker Services LLC; and the organization’s first president, Jim Hinrichs, who passed suddenly April 28, a month after the meeting ended.

Following brief comments by Casey on WTUI’s value proposition, how to extract maximum value from the meeting, introductions, program comments, etc, the president invited Kawamoto to the podium to deliver the Treasurer’s Report. Finances were in order and positive, and accepted by voice vote. Kawamoto then reviewed plans for future meetings with the organization’s 25th anniversary conference and expo at the Long Beach Convention Center, next March 15-18, at the top of his list. The group plans on returning to Palm Springs in 2016 and revisiting Las Vegas in 2017 (last there in 2001).

Depot presentations

Reports by each of the four depots—ANZGT (Air New Zealand Gas Turbine), IHI Corp, MTU Maintenance Berlin-Brandenburg, and TransCanada Turbines (TCT)—followed the business portion of the session.

ANZGT. Mal Waite, commercial manager, reviewed the company’s capabilities and safety culture, capping off his talk with an entertaining film on safety in a beach setting. John Callesen, who manages the company’s Bakersfield (Calif) shop, and Frank Oldread, GM of the US operation, were at the front of the room with Waite. Recall that Oldread was a member of the WTUI leadership team when he wore a user’s shoes.

ANZGT offers Level 1 to 4 repair and overhaul services on LM2500 and LM5000 gas turbines out of its Auckland (NZ) depot and Level 1 and 2 repairs/services at its Bakersfield facility. Teams of field-service technicians are based at both locations and operate 24/7 for immediate mobilization. In 2010, the company became the sole LM5000 parts supplier to the world market and the depot repair facility for GE’s LM5000 lease fleet.

IHI’s Yoshio Yonezawa, VP energy and plant operations, reviewed the 161-year-old company’s products and services, stressing its “Realize Your Dreams” motto. He mentioned IHI’s expanding participation in the Level 2 depot in Cheyenne that it opened with Wyoming-based Reed Services Inc about two years ago.

Koji Hibino, SVP of the Cheyenne Service Center, followed Yonezawa at the podium and offered more detail on the US facility. It handles consulting inspections, engine/module replacement, HP and LP compressor airfoil repair/replacement, onsite maintenance and troubleshooting (up to Level 2), implementation of service bulletins, etc. Ken Ueda, well known to LM users, continues as the service manager in Cheyenne.

In Japan, IHI operates a Level 4 GE-authorized depot for the LM2500 and LM6000 from its shops in Kure and Mizuho and has a dedicated test cell for LM engines in Kure. Satellite repair facilities are located in Thailand and Australia. IHI has LM6000PC and PD machines available for lease also has a “remote witness” online monitoring center in Tokyo for abnormality detection analysis. The company’s goal is to identify and resolve problems before breakdowns occur, thereby improving the performance and reliability of customer equipment.

MTU Maintenance’s Burkhard Schulz spoke first for the company as he has for several years, but only briefly this time. Schulz returned for his 14th consecutive Western Turbine meeting to thank the organization and MTU customers for their loyalty over the years and to introduce Steffen Richter as the new business leader for industrial gas turbines (IGT). Schulz retires later this year.

Uwe Kaltwasser, director of sales and customer support for the IGT segment of the aerospace company and well known to many attendees, followed Richter. He began with a capabilities review of the Level 4 Ludwigsfelde shop, MTU’s center of excellence for the repair of industrial gas turbines. A short video provided valuable perspective of the world largest shop licensed by GE. MTU is an authorized service provider for LM2500, LM2500+, LM5000, and LM6000 engines. The company and its affiliates operate Level 2 shops in Ayutthaya (Thailand), Mongstad (Norway), New Braunfels, Tex, and Brazil. It has nearly 700 employees and hosted more than 1000 shop visits in 2013.

MTU’s test cell in Ludwigsfelde is designed to accommodate and test LM2500, LM2500+, and LM6000 gas turbines under actual operating and load conditions, thereby assuring that maintenance work is performed in accordance with best industry practices. LM5000s are tested on an aircraft-engine test bed.

TCT. President Dan Simonelli stressed the company’s commitment to safety and described its HandSafe program. TCT has been recognized as one of Canada’s safest employers; last year it ranked No. 2. Dale Goehring, well-known to aero users, followed Simonelli with a capabilities presentation. The company’s new Level 4 Airdrie plant with state-of-the-art equipment and tooling is located about 20 minutes north of Calgary. It handles all models of the LM6000, as well as the LM2500 and LM2500+.

Recall that TCT is a joint-venture company between TransCanada Corp and Wood Group GTS. It employs 230 people worldwide and operates Level 2 “hospital shops” in Bakersfield, Syracuse, Houston, and Glasgow (Scotland). Ongoing employee training by the OEM is a requirement; all technicians get 50 hours of formal education annually.

Goehring also discussed TCT’s test facility in the Airdrie facility, now fully operational. It enables the company to provide incoming engine testing, troubleshooting, and diagnostic services for all models of the LM6000. Load banks are used to dissipate the power produced during testing.

The OEM’s team included Gabriel McCabe and Lance Herrington of GE Distributed Power and Cynthia Kantor of GE Power & Water. McCabe is responsible for customer partnerships (Americas) for the Distributed Power organization which aggregates aero GTs, Waukesha diesels, and Jenbacher engines for power generation, mechanical drive applications, mobile power, etc. The company’s commitment to EHS, quality, delivery, cost, and productivity was discussed in prepared remarks as was the supplier’s diagnostic monitoring center now tracking more than 400 units—undefined as to size, type of prime mover, purpose.

The Axford Report

|

|

|

Mark Axford, the Houston-based consultant considered by many to be the leading independent expert on gas-turbine (GT) markets, predicted that US orders for GTs would increase by 15% this year over the nearly 6 GW purchased in 2013. Worldwide, he expects a decline of 5% from the 61 GW booked last year. The Eurozone’s lingering recession is a significant factor in the downward pressure on international orders (less 800 MW in both 2012 and 2013).

The Axford Report, as the annual presentation at WTUI has come to be known, traditionally opens the meeting on the second day of the event. It is highly regarded by conference attendees and always attracts a large audience. Axford’s perspective and data help guide business decisions made by the more than 200 equipment and services providers that regularly participate in the world’s largest meeting dedicated to aero engines in land and marine applications.

The market analyst began with a mea culpa for overestimating his AxSpectations of 25% US growth in 2013 compared to 2012. The market surge predicted was, in his words, a “no-show,” with actual orders down by about 5% from the total recorded a year earlier.

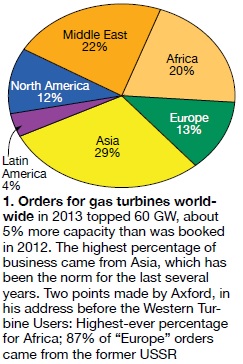

Worldwide, Axford had expected 5% growth and he nailed that within a few tenths of a percentage point. Geographically, 29% of the orders were from Asia, 22% from the Middle East, and 20% from Africa (Fig 1). Regarding Africa, the lion’s share of its orders was committed to Algeria, which bought nearly 9800 MW in 2013. Interesting to note is that Algeria’s generating capability at the end of 2011 was only about 11 GW.

OEM market share. Globally in 2013, Siemens and GE combined for 76% of the total order book for units larger than 10 MW, as they had a year earlier. However, in 2012 the split was Siemens 36%, GE 40%; this year Siemens captured only 29% of the market. GE’s 47% share, its best competitive performance since 2002, was strongly influenced by success in Algeria where GE captured 80% of the 2013 orders, valued at $2.7 billion.

Mitsubishi Hitachi Power Systems finished a solid third with 16% of the market; in 2012 it booked 17%. With Mitsubishi, Hitachi, and the former Pratt & Whitney Power Systems merged into one entity, it’s unlikely that any company will push MHPS out of the No. 3 position. More likely is that Mitsubishi Hitachi will grow its market share.

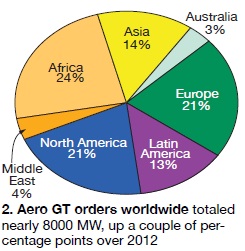

Axford breaks out the aero stats for WTUI attendees. In North America, 2013 orders totaled 1630 MW, he told the group, with 85% of the order book going to GE. Slightly more than one-third of the total was purchased to serve as compressor drives for the oil and gas industry. Worldwide, aero orders in 2013 totaled nearly 8 GW, up slightly from 2012 (Fig 2). GE garnered more than 80% of the total aero business globally.

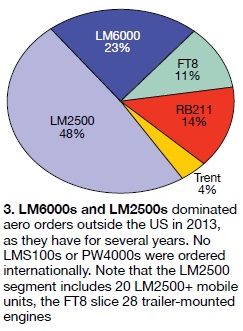

Fig 3 illustrates that aero orders outside North America were dominated by sales of LM2500 and LM6000 engines. By contrast, North American aero orders for electric generation service were a mixed bag: GE LM2500s, LM6000s, and LMS100s accounting for 5%, 15%, and 38%, respectively, of the total, and MHPS’s FT4000™Swiftpac®, 7%. Aeros purchased as compressor drivers were 13 PGT25+G4s, accounting for 27% of the total, and two Rolls-Royce RB211s, 8%.

Global orders for the popular LM6000 totaled 32 engines in 2013 down 10 from a year earlier. Only two LM6000s were purchased by US generators; none were sold into the Eurozone. Sales of the LMS100 rebounded from two in 2012 to six last year—all for US service, including five in California. To date a total of 62 simple-cycle units have been ordered, 44 for the US. Industry sources have told the editors that the premium price for the LMS100 might make it unattractive to at least some international prospects.

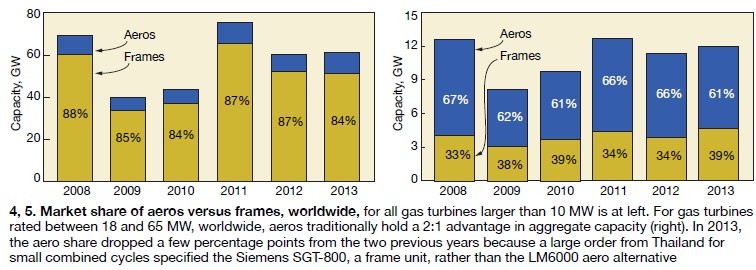

Aeros versus frames. Fig 4 shows that the split between aeros and frames has remained relatively constant for the last several years, with the latter capturing 84% to 88% of the business. But aeros are the clear choice among users for gas turbines rated between 18 and 65 MW, which includes all the LM engines supported by WTUI (Fig 5).

Simple cycle versus combined cycle. About 71% of the gas turbines ordered last year for US service will serve in combined cycles, the balance in simple-cycle applications. This percentage is significantly higher than the 61% averaged over the last five years, based on Axford’s numbers. Going back further in time, the market split was closer to 50/50, the consultant said. Perhaps the ability of the latest combined cycles to start faster because of equipment design improvements and better startup procedures make owner/operators more inclined to cycle these units and compete against simple-cycle engines for some business that in the past was almost exclusively theirs.

The SPS Report

CEO Sal DellaVilla and his team of engineers at Charlotte-based Strategic Power Systems Inc (SPS) trend the performance of gas and steam turbines worldwide, enabling owner/operators to benchmark their assets against peers. SPS data are held in high regard by WTUI and its members. While preparing for the 2014 conference, the company’s experts compiled the following summary of aero-unit performance over the last several years.

CEO Sal DellaVilla and his team of engineers at Charlotte-based Strategic Power Systems Inc (SPS) trend the performance of gas and steam turbines worldwide, enabling owner/operators to benchmark their assets against peers. SPS data are held in high regard by WTUI and its members. While preparing for the 2014 conference, the company’s experts compiled the following summary of aero-unit performance over the last several years.

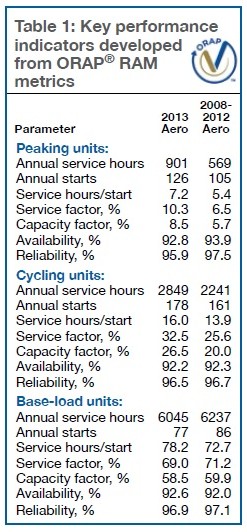

Data extracted from SPS’s proprietary Operational Reliability Analysis Program (ORAP®) are presented in Table 1. The metrics presented—annual service hours and starts, service hours per start, service and capacity factors, availability, and reliability—were calculated using data gathered across the globe from plants that participated in the ORAP program in 2013, as well as during the 2008-2012 period used in the comparison.

The information is presented by duty cycle. Interesting to note is that for peaking and cycling units, annual service hours and starts, as well as service hours per start, increased significantly from the averages compiled for the 2008-2012 period to the numbers recorded in 2013. And as you might imagine, there is a reliability and availability penalty associated with increased operation. Availability and reliability numbers for both peaking and cycling units were slightly higher in the 2008-2012 period than in 2013.

One of the goals of the Western Turbine meeting is to help owner/operators recapture that lost performance. While past performance may not predict future performance, it does matter and should be understood because it sets market expectations and establishes the baseline for product improvements.

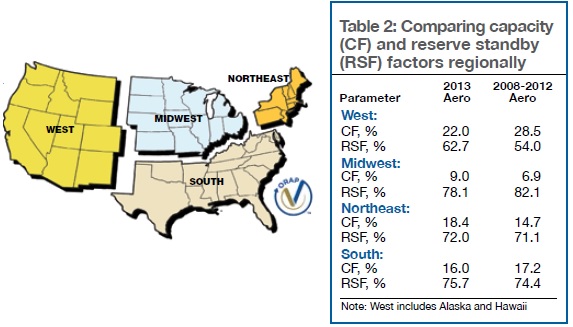

Regional impacts. To better understand how operating paradigms varied by region from 2008-2012 to 2013, SPS engineers compared ORAP capacity-factor and reserve-standby-factor data for the Northeast, South, Midwest, and West in Table 2. Noteworthy is that low gas prices, combined with the need to support intermittent renewables, increased the aggregate capacity factor for aeros in the middle of the country by 30% and in the Northeast by 25%.

Social events

Social events are critical to the success of every user group because they allow attendees to meet in a relaxed environment and expand their networks for problem-solving. There were five major social events on the agenda for the 2014 meeting, made possible, for the most part, by vendor contributions. Here are thumbnails:

- Sunday golf was at the Escena Golf Club, a Nicklaus-designed, 7200-yard championship course. Format: four-person, 18-hole shotgun scramble. Chairmen: WTUI Treasurer Wayne Kawamoto and VP Jim Bloomquist. There were 138 participants this year—far too many to mention (Figs 6, 7).

- Sunday tennis was at the Plaza Racquet Club. Only seven participants this year (Fig 8), perhaps because the sport is too strenuous (unlike golf, tennis players actually sweat).

- Jeep tour for significant others of the Palm Springs Indian Canyons focusing on the history, culture, and lifestyle of the Cahuilla Indians, whose ancestors lived there. There were more than 50 participants in this event (Fig 9).

- Evening reception at the Palm Springs Air Museum featured aircraft from WW II to present. Plus Top Gun Academy, the Andrews Sisters on the Bob Hope Stage, sidebars with volunteer pilot-historians who actually flew the planes (Fig 10).

- Evening reception alongside the huge Renaissance Hotel pool was sponsored by the depots and featured foods and adult beverages from the sponsors’ countries—Canada, Germany, Japan, and New Zealand.

Awards

WTUI presents awards annually during lunch on the first two days of the meeting. At one, golf and tennis awards are the focus; at the other lunch, recognition is given for service to the organization. This year, the CCJ’s Best Practices Awards to LM aeros was integrated into the program. Awards included the following:

Golf. The first place men’s team was represented by Andy Stewart, A&I Component Support Ltd; Kevin Roller, AAF International; Jerry Weinle, GE Distributed Power; and Kyle Bryan, TurboCare.

Tennis. Jackson Chu, ST Aerospace, received the championship racquet.

WTUI Service Awards went to Directors Ed Jackson of Missouri River Energy Services, Charles Byrom of the Anaheim Public Utilities Dept, and John Baker of Riverside Public Utilities (Figs 11, 12).

Best Practices Awards went to the following plants:

- For Monitoring and Diagnostics, Panoche Energy Center, owned by Energy Investor Funds and operated by Wood Group GTS Power Plant Services (Fig 13). Plant staff implemented a real-time performance monitoring system to maximize plant efficiency based on contractual obligations, resulting in a substantial increase in variable revenue.

- For Monitoring and Diagnostics, Corona Cogen, owned by WCAC Operating Company and operated by CAMS (Fig 14). In-house development and implementation of a comprehensive interactive plant management system effectively streamlines regulatory compliance and plant maintenance. Benefits include lower operating costs, higher availability/reliability, and increased transparency. CCJ

Editor’s note: Technical coverage of the 2014 Western Turbine conference will appear in the next two issues of CCJ.