California clean energy, and the rest of the West

by Jason Makansi, Pearl Street

Arguably, California is attempting to implement the nation’s most ambitious clean energy plan. That strategy is a convergence of the following elements:

- A 33% Renewable Portfolio Standard (RPS) by 2020.

- A state carbon-reduction and cap-and-trade program (AB32).

- Significant incentives and subsidies for distributed energy and storage, and demand management and efficiency.

- An electric vehicle (EV), natural gas, and transportation infrastructure development program.

- A clean jobs program.

- Add to the items above, new emissions and thermal-discharge restrictions on existing fossil plants, and some of the nation’s most onerous environmental, ecological, and land-use policies.

But the state has never existed as an island in the context of energy. Some of its water comes from other states (via the Colorado River, for example), and water is of course critical to electricity production. Hydropower from the Pacific Northwest provides a significant share of the state’s electricity. An insignificant amount of natural gas is sourced in California, but the state has the third highest consumption of that fuel for electricity production.

Some of the country’s best wind is located offshore California, yet few leaders, if any, are discussing how to harness it. Two nuclear plants have operated in the state for decades but no one talks about building new ones. And, despite what you may read about the California exodus, it’s still the most populous state in the nation.

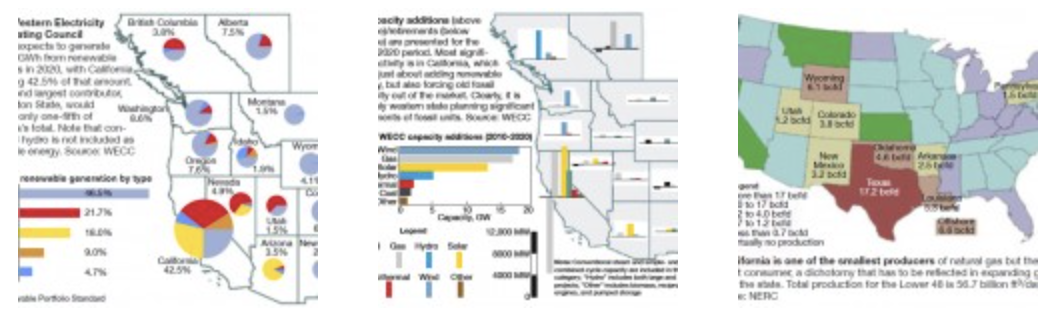

Where is all the clean energy going to come from? Neighboring states, you say? Almost all of them face compliance with their own RPSs and other clean-energy goals, though none nearly as aggressive as California’s (Fig 1). And California’s desire to reinvigorate its economy through clean energy means that it is restricting clean energy imports to create in-state jobs.

The impact of California on the “rest of the West” is a complicated puzzle with many moving pieces and parts, contradictions, regional synergies, and opportunities. Pearl Street Inc and PGS Energy Training have developed an insightful workshop to help executives and managers at generating plants and headquarters locations understand the ramifications, nuances, opportunities, and pitfalls of the state’s clean-energy policy.

What follows are excerpts from the first workshop, “California Clean Energy and the Rest of the West,” held in April in Sacramento. It will be updated and repeated October 10-11 in Portland (visit http://www.pgsenergy.com/classroom-seminars for details). Contact Jason Makansi (jmakansi@pearlstreetinc.com) if you have any questions.

One can envision many different scenarios for how Western US energy flows will change over the next 10 years. Yet one thing is almost certain: Gas-fired gas turbines will play a bigger role in meeting the state’s challenges.

State polices up close

Some of the pieces and parts of the California strategy deserve a closer look. One interesting element, especially for large combined-cycle advocates, is the state’s goal to have 20,000 MW of new renewable capacity. The lion’s share, 12,000 MW, is intended to be localized distributed energy systems up to 20 MW each in size. Generous incentives are available for those projects.

The state has also defined multiple renewable energy zones and 13 critical transmission projects to bring distributed power to load centers. Thus, California isn’t just pursuing an ambitious clean-energy plan, it seeks to convert the system from one traditionally dominated by long wires and large, centralized power stations. This would, to use a cliché, break the paradigm.

AB32, the carbon reduction legislation, seeks to reduce greenhouse gases by 20% of 1990 levels by 2050. In part to achieve this, 2000 MW of contracted coal capacity will be eliminated. But the bigger and more worrisome piece of AB32 is imposing new thermal discharge restrictions (AB1318) that could force out 13,000 MW of fossil capacity (Fig 2). AB32 doesn’t just cover power stations either; all facilities for which GHG emissions exceed 25,000 tons/yr are governed by the legislation, which reportedly captures 600 facilities.

Do the math: 15,000 MW of fossil gone, replaced by 20,000 MW of renewable energy. Looked at another way, the state plans to replace 15,000 MW of largely amortized fossil plants, which typically can operate at capacity factors of 50%-90%, with systems that operate at 30%-40% capacity factor, and are highly variable—daily, weekly, and seasonally. This will significantly change the operating characteristics of the grid.

Two other pieces of the strategy deserve mention:

- AB2514 encourages the development of energy-storage technologies, although most of the distributed storage technologies are not yet ready for commercial deployment.

- The California Electric Vehicle Collaborative seeks to have up to 1-million EVs on the road by 2020; plus, vehicles fueled by compressed natural gas.

Regionalism: A federal goal?

When it comes to electricity production and delivery, the federal government clearly has been pushing states and their utilities towards a regional approach for many years. Five years ago, the FERC essentially mandated, through Order 890, that utilities, or at least transmission providers, participate in Regional Transmission Organizations (RTOs), all of which include markets to promote competition, in varying degrees, for wholesale electricity purchases and services. In 2001, FERC also attempted to regionalize electricity through “standard market design,” an initiative which ultimately failed.

FERC’s latest initiative, Order 1000, (1) requires transmission entities to create regional transmission plans; (2) seeks to make transmission development more transparent and therefore more susceptible to competitive forces; (3) eliminates the right of first refusal for incumbent utilities to develop transmission; and, most importantly, (4) allows public policy goals, not just reliability and “just and reasonable rates,” to be included in transmission planning. Costs can be allocated across the RTO or independent system operator (ISO) “footprint” as long as they are commensurate with estimated benefits.

The Obama Administration also has created a Rapid Response Team for select interstate transmission projects to coordinate among all the federal agencies with something to say about where, how, and when transmission lines can be permitted. DOE has funded regional grid evaluations like the Western Renewable Energy Zone (and the Eastern Interconnection Planning Collaborative), and has provided guaranteed loans for clean-energy projects—including wind, solar, and nuclear.

The Dept of the Interior is streamlining federal permitting for renewable energy. Congress has done its part by introducing the Clean Energy Standard Act of 2012, which seeks to establish a federal clean-energy credit trading program. The Western Governors Assn also has a Renewable Energy Zone Initiative.

These and other policy initiatives pave the way for greater availability and integration of clean energy flows among California and its neighbors. Or do they?

Countervailing forces

One of the problems with regionalism is that there are no regional governments. There can be agreements, coordination, and strategies but in the end, only the state or the feds can pass laws—and all can be challenged in the courts.

Here are a few other observations about California and the West:

- California has a functioning electricity market and wholesale competition. The other western states, and California as well, participate in the Western Electricity Coordinating Council, which does not promote competition to nearly the same degree.

- California is creating its own carbon cap-and-trade system. The state could be disadvantaged because its neighbors are not imposing the same costs on their state economies.

- If costs rise significantly in California because of its clean-energy policies, then neighbors could benefit when jobs shift from high-cost California to lower-cost states.

- If the transmission system isn’t expanded, the clean energy isn’t going to get to where it is needed.

California’s own Clean Jobs program overtly biases development towards in-state. And the fine print of the RPS directs that in the later years of the program, towards 2020, clean energy imports will be restricted. The strategy is to allow imports in the early years until other infrastructure is in place so that the state can meet more of its needs within its borders. Ultimately, 75% of the RPS must be met with “in-state bundled transactions (renewable energy credits plus capacity). Owner/operators are not likely to build facilities in neighboring states for an opportunity to sell into California for only a few years.

Then there are the hard macro-realities of the electricity business today. While the costs for renewable energy have been declining, the historically low price of natural gas essentially has put every other generating option in jeopardy. Electricity demand destruction, a consequence of the recession, an anemic recovery, and moderate weather patterns, means that utilities are not making much money, so there is less money to invest and less need for capacity. Finally, most governmental entities, whether federal, state, or city, are in debt up their eyeballs.

In short, it’s probably not the best time to force amortized powerplants to shut down and replace the capacity with more expensive clean energy.

Unfortunately, there are other forces that are likely to restrain the state’s ambitions in clean energy. First, California is in the midst of a budgetary crisis, and cuts are going to come from somewhere. Second, the desire to restrict out of state renewable energy flows to grow the state’s economy may not hold up to a challenge based on the Interstate Commerce Clause.

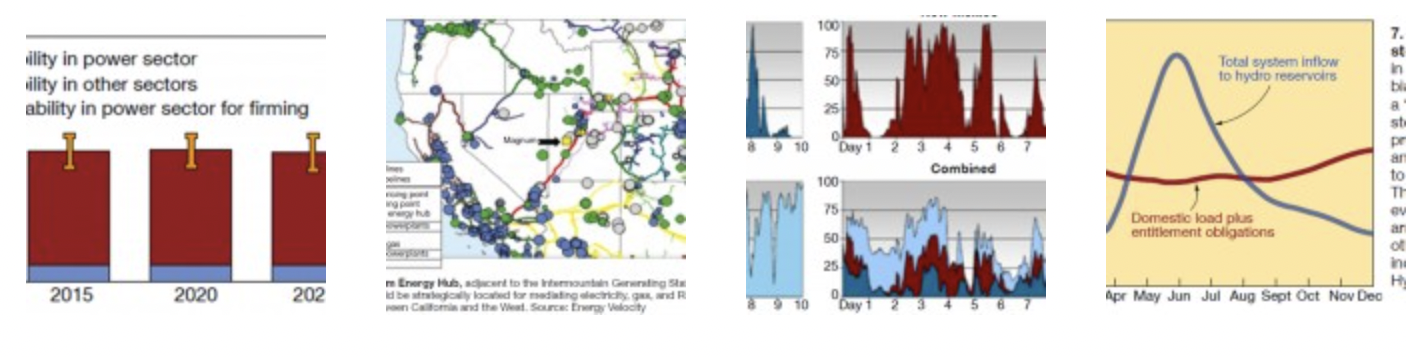

Third, the electric and gas transmission systems must be expanded (Fig 3) if renewable energy from the region is to fulfill its promise and natural gas fired plants are going to manage the renewable energy variability. Fourth, costs to comply with the carbon reduction laws may derail economic growth, and electricity demand, if companies decided to close up shop instead or transfer manufacturing and production capacity to other facilities. Finally, an oppositional political movement is waiting in the wings for a change in administration.

Train wreck ahead?

California policy-makers could manage this dynamic and delicate policy puzzle in such a way that its economy grows from clean-energy manufacturing and clean-energy facility construction without high energy costs that would drive business out of the state. The regional development of clean energy could occur in tandem, so that California gets what it needs in terms of imports and the rest of the states meet their own goals. Deployment of electric vehicles and transportation networks also escalate electricity demand, although latest projections show that EVs shift demand more than they grow it. But to have all this unfold smoothly would be a feat of politically epic proportions.

It is just as easy to envision a different scenario—one in which the needed transmission lines are not permitted and built, utilities delay procurements for new capacity, an immediate need for jobs takes precedence over cleaner air, other states revert to parochialism because of lack of economic growth, and changing political dynamics result from the upcoming presidential election. A close analysis shows that the Obama “energy strategy,” at least when he first came into office, is quite similar to one California is pursuing.

Another alternative scenario might be that state’s economy begins to grow fast and new capacity has to be added quickly.

Hedging your bets

Given all of this uncertainty, if you had to hedge your bets as a planner or industry executive, what would you do? Well, your ace in the hole is probably going to be a gas-fired plant. Here’s why:

- If renewables come on stream in a timely manner, then the gas plant will be used to fill in around the intermittent availability of solar and wind.

- If renewables do not come on stream in a timely manner, then you can run the gas plant at higher capacity factor, perhaps buying Renewable Energy Credits (RECs) to cover your carbon emissions, or arguing for an extension on compliance with the RPS.

- If electricity demand begins to rise unexpectedly, a gas-fired plant can be permitted and built faster than any other option, even in California.

- If you needed peaking capacity initially, you could install a simple-cycle gas turbine/generator and add the steam bottoming cycle at a later date—if demand dictated.

As one California utility manager put it, at least you can take a gas-fired plant and a 10-yr contract for favorable and predictable gas prices to your investment committee and/or the PUC.

It pays to keep in mind that 2020, the deadline for the 33% RPS, is only seven and a half years away. That’s the equivalent of a California minute in utility planning time scales.

Meet the workhorse

All things considered, then, California and the West are in for a mini-boom of gas-fired plant construction and the evidence is already there (access “By the numbers,” CCJ 1Q/2012, at www.ccj-online.com). One OEM calls its new flexible combined cycle “a high-efficiency combined cycle with a smaller peaker inside.” First commercial units, which feature a larger compressor with multiple rows of variable guide vanes, are operating this year, reportedly able to meet the following performance specifications:

- Turndown to 40% of base-load capability while remaining emissions compliant (excluding CO2).

- 30 MW/min ramp rate in simple cycle.

- 60 MW/min ramp rate in a 2 x 1 configuration.

- 400 MW of total ramping capability from a 2 x 1 combined cycle.

- 10% more power at the highest efficiency point.

- Adds capacity in excess of base load even when ambient temperature rises (which normally reduces efficiency and capacity).

All of this reportedly with no impact on service life. All of the major turbine vendors are pushing models with similar capabilities.

During the workshop, these performance specs got a chuckle from two combined-cycle plant operators in the room. They both contend that their facilities achieve the same or at least similar flexibility in following load. “Flex” or “shaping power” gas turbines, they said, is sales language. Adding a clutch between the gas turbine and generator allows the unit to also operate in the synchronous-condenser mode and provide reactive power to the grid as an ancillary service.

Gas/renewable integration

While it may seem fairly straightforward to simply plunk down new gas turbine systems, it isn’t. Most people are familiar with the difficulties acquiring permits in California.

But another issue experts hadn’t been focused on until recently is delivering the fuel gas to powerplants in a manner that matches expected operating profiles of the new plants. The massive gas transportation infrastructure in this country is a storage medium of sorts, but it has been built around seasonal demand profiles.

If gas turbines are to “follow the wind or sun” then their daily operating profiles will change substantially. In fact, two combined-cycle plant operators in the workshop confirmed that their dispatch profiles had changed to reflect renewable energy systems serving the system.

Thus, natural-gas delivery has to meet new operating profiles. At least one study shows that the 10-min variability in the power sector for firming gas delivered from Wyoming to California could more than double (Fig 4). NERC is sufficiently worried about such issues, and the impacts they may have on electric system reliability. It is considering new reliability standards, monitoring and tracking systems, lines of communication, and outage coordination between pipeline operators and powerplant owner/operators.

The California Independent System Operator (CAISO), not surprisingly, is also worried about the flexibility of the existing fleet to handle variable renewable energy. One reason is because AB1318 could knock out much of the existing oil/gas-fired boiler fossil fleet that has cycling capability. CAISO expects regulation up/down requirements to change considerable, even under the older 20% RPS mandate.

New approaches abound

There are many ways to balance renewable energy on a regional basis. Since utilities and their stakeholder public utility commissions (PUC) overwhelmingly converge on the least-risk, least- cost approach, most of these may not be implemented for many years. However, they are still worth a mention.

1. Western Energy Hub. One private developer seeks to combine cavern-based natural-gas storage and compressed air energy storage (CAES) at a location near the Intermountain Power Plant in Utah which feeds directly to Los Angeles Dept of Water & Power via a dc transmission line. Given the discussion above regarding gas delivery, and knowing that Wyoming is fossil-fuel and wind rich, and Colorado is developing its wind resources at a rapid clip, it’s easy to see how such a facility could intermediate natural gas, renewable energy, and RECs flows into and out of California (Fig 5).

2. Pumped storage. Virtually all the energy storage in the world (99%) serving electricity grids comes from pumped hydro storage (PHS). Over 40 new facilities, including those proposed and those which have applied for a preliminary FERC permit, dot the western planning map. Utilities are very familiar with this technology and the latest models incorporate variable speed technology to make them even more responsive and flexible. Biggest challenges facing PHS are development and construction schedules that are often seven to 10 years, and high capital costs. However, from a life-cycle cost point of view, they are very attractive.

3. Regional coordination. Wind turbines operate within “ideal conditions” only 10% of the time. However, if grid operators and wind facility operators closely coordinated supply and demand, combined performance data, meteorological data, statistical models, advanced real-time communications, and improved sensor technologies, renewable energy flows could be balanced with demand on a wider regional basis.

You could add to this a layer of demand management on the distribution side of the electric system. While in theory, this approach probably involves the least cost in new infrastructure, it is difficult to envision how such coordination could be achieved on a practical basis. There is also evidence that the wind distribution among the different states doesn’t match well, anyway (Fig 6)

4. Cross-border hydro management. Perhaps the most intriguing idea for regional management lies to the north. BC Hydro has a large multi-year hydro storage system associated with approximately 70% of the utility’s energy production. In essence, BC Hydro’s system could release water when needed and send electricity south, providing shaping and firming services to the Pacific Northwest and California (Fig 7). CCJ