Alex Hoffs, president of PSM, opened the 2025 PSM Asset Manager Conference (AMC) by reinforcing PSM’s dedication to innovative clean energy solutions aimed at benefiting future generations. He outlined the mission to meet customer demands through a flexible, reliable, and efficient portfolio that enhances asset lifecycle costs. Emphasizing the company’s core values—agility, innovation, and trust—Hoffs highlighted PSM’s achievements and strategic direction, including its significant global presence and performance metrics.

Hoffs also discussed PSM’s commitment to technological advancement, detailing their continuous product development trajectory. Part of the very attractive GT upgrades offerings are key innovations like the FlameSheet™ introduced in 2015, incremental enhancements to combustion pilot systems between 2018 and 2021, and ongoing advancements aimed at improving startup emissions and fuel robustness by 2025 and beyond. These strategic initiatives are vital in addressing today’s energy challenges and optimizing operational efficiencies in the electric generation sector.

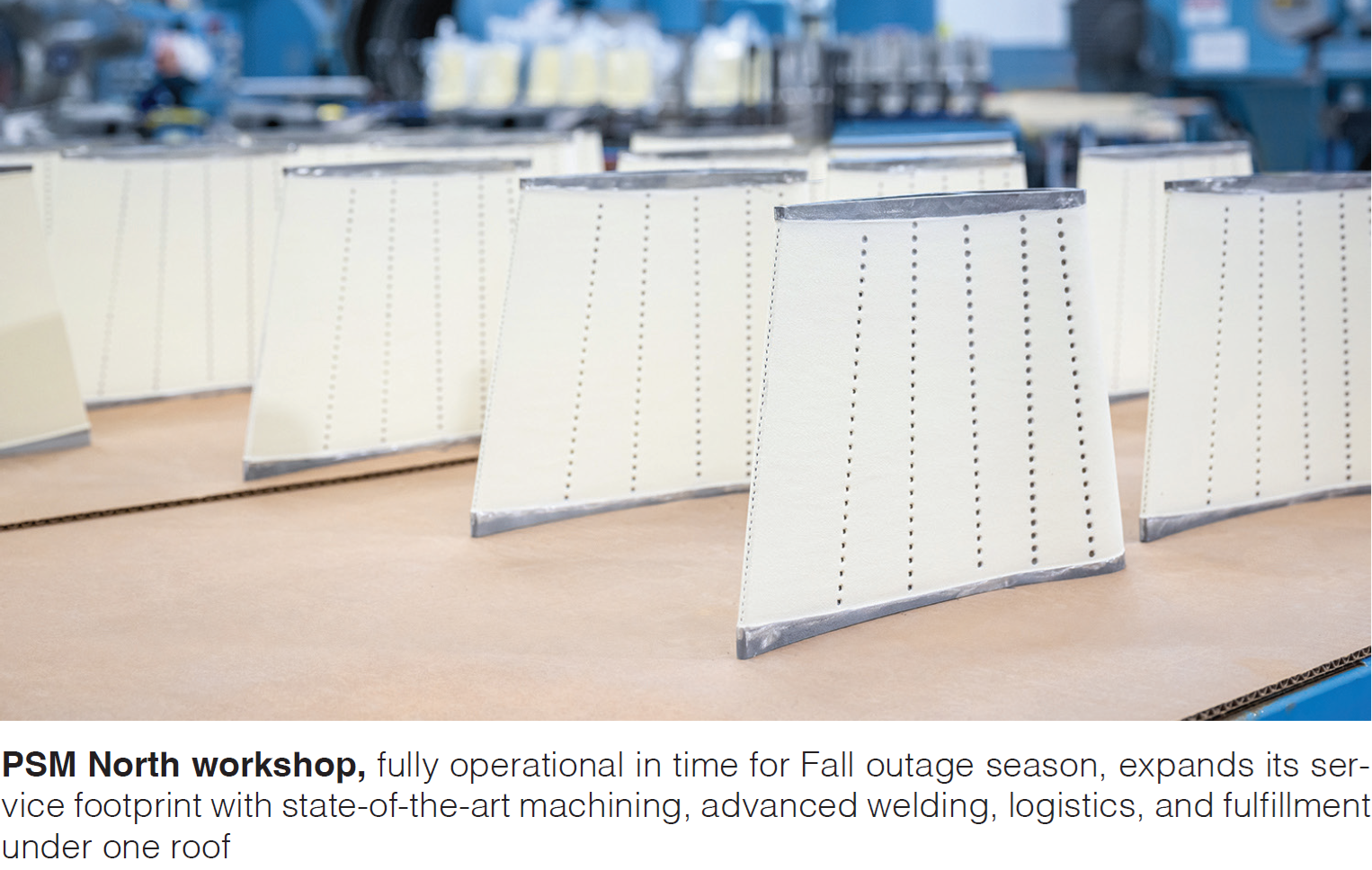

Powering expansion: Welcome to PSM North

Perhaps the biggest takeaway from Hoffs was his introduction of the company’s latest milestone: the launch of PSM North, a new workshop, customer fulfillment, and logistics center in Stuart, Fla. The facility, set to begin operations in Summer 2025, marks a major expansion of PSM’s capabilities, complementing its flagship workshop in Jupiter, just 25 miles away.

The 185,000-square-foot facility will focus primarily on repairs for combustion and stationary product lines, with 85,000 square feet dedicated to advanced workshop operations and 100,000 square feet allocated for warehousing, inventory, kitting, and logistics support. Included is an office space that will also house supply chain quality and related functions—bringing fulfillment, logistics, and manufacturing under one roof.

Core technical capabilities include:

- Precision machining (manual, 3-, and 4-axis CNC)

- Electro Discharge Machining (EDM): wire, plunge, and hole popping

- Vacuum heat treatment and brazing for both manufacturing and repair

- Industry-leading flow testing and combustion support

- Advanced welding techniques (TIG, MIG, laser) and fabrication services

- High-precision metrology: structured light scanning and engine assembly checks

With this expansion, PSM is significantly increasing its footprint and strengthening its ability to deliver high-quality, reliable service to customers around the globe, especially in the USA.

Powering the transition

Jeff Benoit, VP of clean energy solutions, offered a sweeping overview of global and domestic power market trends, highlighting both progress and challenges for the energy transition.

Globally, countries are accelerating their renewable energy efforts. China remains the dominant force in renewable energy and electric vehicle manufacturing, while Japan and South Korea are investing in ammonia as a decarbonized fuel. Australia is pushing forward with large-scale green hydrogen projects. In the Middle East, the UAE is leveraging its sunny climate for ultra-low-cost solar power, while Saudi Arabia’s NEOM initiative focuses on clean ammonia exports and the development of a digital economy powered by renewables.

Europe continues to lead in power market transformation, with Germany announcing 20–30 gigawatts of new gas turbines to support its transition. The EU, where renewables have surpassed fossil generation, is building infrastructure for LNG and ammonia imports and implementing carbon pricing mechanisms to manage emissions. Meanwhile, Mexico, heavily reliant on U.S. natural gas for electricity, is enabling renewable growth through structured climate laws.

Domestically, gas turbines produce over 40% of the U.S. electricity and are expected to remain vital due to their flexibility in supporting intermittent renewable energy. A notable trend is the resurgence in demand for power, largely driven by a surge in data centers fueled by AI. This development is seen as a “Sputnik moment,” signaling the start of a new era requiring massive infrastructure investment and innovation.

The U.S. gas turbine pipeline shows approximately 75 gigawatts in development, especially in the SERC and ERCOT regions, according to EPRI. These include both large and small-scale installations, as well as complementary internal combustion engines to meet fast-evolving reliability needs.

Benoit also told the Florida story, where solar is rapidly expanding, although natural gas still dominates. Here, gas turbines are not only essential for base and peak load power but are increasingly important to stabilize the grid as solar capacity grows.

The U.S. power grid is being tested by the convergence of electrification, industrial growth, and extreme weather. States like Ohio, Indiana, and Virginia are experiencing rising demand due to data centers and onshoring of manufacturing. Nuclear energy is seeing a potential revival as part of strategies to meet this load sustainably. But, for now, Benoit emphasized that gas turbines remain central to maintaining grid reliability, integrating renewables, and keeping energy costs manageable.

His message was clear: the industry must invest, innovate, and adapt quickly to meet the transformative needs of a decarbonizing and electrifying world.

Industry innovation panel

Moderated by Katie Koch and Dan Caggiani of PSM, the panel discussion featuring asset managers and industry experts explored both the innovative strides being taken and the significant challenges in the gas turbine industry.

A key focus was on technological innovations shaping the industry. GTs are increasingly being adapted to support decarbonization strategies across the globe. This includes the integration of low-carbon fuels like hydrogen and green ammonia. The ability of turbines to operate on these diverse fuel types is seen as a critical enabler for future energy systems, particularly in regions such as Asia and the Middle East, where such transitions are accelerating.

Another area of innovation is the retrofitting and upgrading of existing GTs. These upgrades extend the life and improve the efficiency and flexibility of turbine operations, allowing them to better complement intermittent renewable energy sources like solar and wind. The industry is also embracing dispatchable aeroderivative GTs to meet immediate and localized energy needs quickly and efficiently.

As demand surges from sectors like AI and data centers, GTs are being aligned to ensure stable, scalable power supply. These installations, particularly in the U.S., are anticipated to be a major driver of power growth, requiring reliable energy infrastructure. Turbines are increasingly viewed not only as base-load providers but as balancing agents that can quickly ramp up to meet fluctuating demands.

Despite these advancements, the industry faces several pressing challenges. Market volatility—especially from unpredictable, rapid increases in demand—is testing the responsiveness of existing infrastructure. Policy shifts and regulatory uncertainty, especially with new governmental administrations and evolving climate mandates, create a complicated environment for long-term investment planning, even if the immediate future looks bright.

Infrastructure development remains a bottleneck, with grid and pipeline expansion often lagging behind turbine innovation. In some states like Oregon, legislative restrictions prohibit new fossil fuel-based generation, compelling the industry to pursue hybrid solutions or innovations like carbon capture.

Public perception presents another hurdle. Although GTs play a crucial role in grid stability and energy security, they are sometimes viewed as incompatible with clean energy goals. To address this, the industry must continue to engage with stakeholders and demonstrate its alignment with decarbonization pathways.

Additionally, perhaps most pertinent to end users is that the supply chain for turbine components faces strain under rising global demand from both the power generation and aerospace industries, leading to deeply extended lead times and logistical complications.

Despite these obstacles, the outlook remains optimistic. Panelists agreed that GTs are irreplaceable for maintaining power system reliability, particularly as electrification accelerates and renewable energy becomes more prevalent. Continued innovation—from advanced turbine designs to AI-assisted grid integration—will be key to meeting evolving energy needs.

Bulk up your 7F with GTOP

The Gas Turbine Optimization Program (GTOP) delivers measurable performance and operational improvements across 7FA and 501F gas turbine platforms. Through modular upgrade packages, PSM offers asset owners the ability to tailor solutions based on maintenance strategy, desired power output, and heat rate reduction goals—all while leveraging additive manufacturing and aerodynamic innovations to drive efficiency. Focus here will be the 7F.

At the core of GTOP is a progression of upgrade packages—from GTOP Lite to GTOP 4.1—that incorporate new hardware designs, control logic, and thermal management strategies. GTOP Lite offers up to a 2.8% increase in power output with minimal hardware changes, ideal for operators seeking incremental improvements. For more aggressive performance gains, GTOP3.1 and GTOP4.1 deliver up to 17.4% increased output and a 3.5% reduction in heat rate through enhancements in compressor aerodynamics, combustion systems, and turbine cooling technologies.

A significant differentiator in PSM’s GTOP approach is its use of modular, additive-manufactured components. PSM’s 501F GTOP7 technology underpins the latest upgrades, reducing part count for easier maintenance, improving durability, and incorporating near-wall cooling designs. These advancements are translated into 7F GTOP4 packages, where 3D-aerodynamic airfoils and enhanced materials yield higher efficiency and longer component life. Notably, the FlameSheet™ Gen VI combustor is available as an option for ultra-low emissions (<9 ppm) and deep turndown capability (<26%), even lower when paired with Exhaust Bleed (ExB).

PSM also emphasized its streamlined upgrade pathway. Each GTOP evaluation includes a comprehensive review of site-specific requirements, compatibility with OEM AGP systems, and the opportunity to mix-and-match technologies such as AutoTune logic and FlameSheet™ hardware. These systems enable mode-switching across maintenance, performance, and peak operation strategies, supporting flexible operation without sacrificing efficiency or reliability.

With more than 50 GTOP installations completed across the F-class fleet and decades of performance data—such as fleet leaders surpassing 56,000 hours and 1,127 fired starts—PSM’s GTOP program has demonstrated proven value. The 2025 roadmap includes new releases like GTOP4.1 and compressor flow enhancements, reinforcing PSM’s commitment to scalable, field-proven turbine optimization.

Announced at the conference and currently underway at a 7F-powered 2×1 CCGT is the first installation of GTOP4.1. Key enhancements to the new package include re-aeroing the entire turbine section, development of second generation single-crystal alloy, S1N advanced cooling via additive manufacturing AM (3D printing) integrated into the modular vane, and a new multi-layer abradable coating system for the S1SB and S1B.

More 7F flexibility. Enhanced low-load operation comes with the integration of PSM’s FlameSheet™ combustion system with inlet bleed heat (IBH) and ExB systems—enabling ultra-low emissions, improved heat rate, and safe, reliable turndown below traditional limits.

FlameSheet™, PSM’s next-generation combustor, is engineered as a “combustor within a combustor” with two aerodynamic stages and four fuel circuits that support wide operational stability. It features high-velocity premixer exit flows and a trapped vortex design, allowing it to tolerate highly reactive fuels like hydrogen and handle variations in fuel Wobbe index. This architecture not only ensures emissions compliance at low loads but also maintains flame stability across a broad operating range.

To further extend turndown capability and protect the HRSG, PSM couples 501F and 7F FlameSheet™ with IBH and ExB systems. IBH works by extracting compressor discharge air and reinjecting it upstream to raise inlet temperatures, which helps prevent compressor icing at low IGV angles. This allows turbines to operate at lower loads in premixed combustion mode, maintaining NOx and CO emissions below 9 ppm.

The ExB system enhances this functionality by redirecting flow from the compressor shell directly to the exhaust. This bypass flow reduces exhaust temperatures while maintaining the combustor’s firing temperature, thus protecting downstream HRSG components from droplet erosion and thermal stress. When used together with FlameSheet™, IBH and ExB enable F-Class turbines to achieve emissions-compliant turndown to as low as 30% load in a 501F and as low as sub-20% load in a 7F —adding roughly 10% more operational flexibility compared to standard configurations.

PSM’s approach was validated through performance curves and emissions data demonstrating stable combustion dynamics and emissions compliance across a wide load range. Turbine operators benefit not only from improved reliability during cycling and low-load operation, but also from the ability to handle more renewables into their grids without compromising turbine readiness or HRSG integrity.

7F rotor tsunami

With the majority of 7F units installed between 2000 and 2004 now approaching their expected end-of-life thresholds, end users have supply-chain concerns because of intense competition for raw materials and manufacturing slots. There is a pressing need for strategic planning, inspection, and upgrade solutions tailored to the evolving operational demands of these assets. Addressing the critical challenges faced by 7F operators, much of the focus was on diagnosing prevalent fleet-wide issues and highlighting the operational and maintenance implications driven by changes in operating profiles.

One of the primary issues discussed was the increasing stress on rotor components due to shifting operational profiles, especially the transition toward starts-based cycling. This operational change significantly impacts fatigue and creep characteristics, elevating the importance of early identification of at-risk hardware. PSM outlined several fleet-wide vulnerabilities, including blade attachment cracking on R0 and R1 wheels, lock wire tab cracks, and design limitations of Spacer 1-2 components. For each of these issues, PSM offered actionable solutions ranging from crack-tolerant wheel replacements to improved material selections and enhanced geometries.

The heart of the session centered on PSM’s comprehensive rotor lifecycle strategy. This includes options such as spare rotor procurement, rotor exchanges, and most critically, their advanced Lifetime Extension Program. Unlike standard repairs, the LTE approach combines full volumetric inspections—using ultrasonic, eddy current, and metallurgical analysis—with proprietary material models and analytical evaluations to assess component health.

These assessments support precise rework recommendations, enabling turbines to safely continue operation beyond original design limits. The LTE framework also includes 2D/3D fracture mechanics modeling and creep life predictions, ensuring that every extension decision is grounded in rigorous engineering.

PSM’s continues investment in new hardware manufacturing, such as upgraded compressor wheels, blades, and spacers, complements its LTE offering. The company currently maintains seed rotors and enhanced back-end compressor stages, which allow operators to avoid long procurement delays while ensuring critical components meet modern reliability standards.

Oh…that old thing?

With many B-E class assets seeing a roadmap to extend beyond their fourth or fifth decade of operation, PSM is noticing a renewed focus on upgrade strategies, emissions control, and lifetime extension.

A broad portfolio of upgrade options tailored to specific operational and market needs are designed to improve emissions, output, fuel flexibility, and overall turbine performance. These included the LEC-III™ and LEC-NextGen combustors, both of which offer ultra-low emissions and enhanced durability. The LEC-III™ features a reverse-flow Venturi system and a robust transition piece to handle increased dynamic loading, while the LEC-NextGen system supports dual-fuel applications and is rated for 32,000 hours and 1,300 starts (Fig 6).

Another key technology featured was the Sequential Fuel Injection (SFI) system, which allows gas turbines to operate efficiently across a wide load range—up to 25% load flexibility—while maintaining NOx and CO emissions below 9 ppm. This system enhances both turndown capability and peaking performance with minimal combustion dynamics, demonstrating a load range from 38% to 112%. Additional upgrades such as the FlameSheet™ combustor, fast start and ramp options (FS1 and FS3), and inlet air systems like IBH and anti-icing (IBHAI) further expand operational flexibility and reliability, particularly in colder climates.

A case study on and 7B-powered CCGT shows a reduction in HRSG inlet temperature and improves turndown performance with the addition of ExB for the first time on this unit. Complementary improvements to exhaust frame cooling, manifold systems, and fuel valve skids were designed to increase durability and streamline maintenance. More detail to come on this project in the coming months as more highlights from the AMC are published. CCJ